Office Depot 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

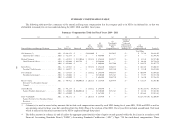

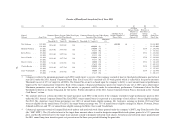

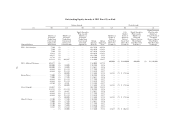

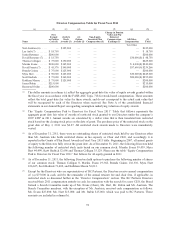

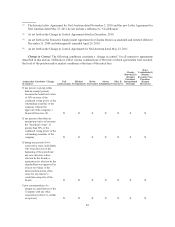

Outstanding Equity Awards at 2011 Fiscal Year-End

Option Awards Stock Awards

(a) (b) (c) (d) (e) (f) (g) (h) (i) (j)

Named Officers

Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable

Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable

Equity Incentive

Plan Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options (#)

Option

Exercise

Price ($)

Option

Expiration

Date

Number of

Shares or

Units of

Stock That

Have Not

Vested (#)

(18) Market

Value of Shares

or Units of

Stock That Have

Not Vested ($)

Equity Incentive

Plan Awards:

Number of

Unearned

Shares, Units or

Other Rights

That Have Not

Vested (#)

Equity Incentive

Plan Awards:

Market or Payout

Value of

Unearned Shares,

Units or Other

Rights That Have

Not Vested ($)

Charles Brown (16) ........... 40,000 (10) — — — $16.0650 2/4/12 — — — — —

40,000 (11) — — — $11.4850 2/14/13 — — — — —

40,000 (12) — — — $17.5450 3/26/13 — — — — —

50,000 (13) — — — $18.0850 2/11/12 — — — — —

25,000 (14) — — — $28.2450 7/26/12 — — — — —

285,423 (15) — — — $11.2700 3/26/13 — — — — —

133,333 (5) — — — $ 0.8500 3/26/13 — — — — —

133,333 (5) — — — $ 1.0625 3/26/13 — — — — —

66,666 (6) — — — $ 7.7100 3/26/13 — — — — —

66,666 (6) — — — $ 9.6380 3/26/13 — — — — —

Daisy Vanderlinde (17) ........ 337,500 (5) — — — $ 0.8500 2/28/13 — — — — —

112,500 (5) — — — $ 1.0625 2/28/13 — — — — —

112,500 (6) — — — $ 7.7100 2/28/13 — — — — —

112,500 (6) — — — $ 9.6380 2/28/13 — — — — —

67,060 (8) — — — $ 5.1300 2/28/13 — — — — —

80,000 (7) — — — $ 5.3400 2/28/13 — — — — —

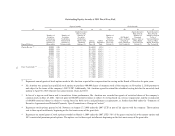

(1) Represents annual grants of stock options made to Mr. Austrian as part of his compensation for serving on the Board of Directors for prior years.

(2) Mr. Austrian was granted non-qualified stock options to purchase 400,000 shares of common stock of the company on November 2, 2010 pursuant to

and subject to the terms of the company’s 2007 LTIP. Additionally, Mr. Austrian agreed to extend the scheduled vesting date for the unvested stock

options to April 30, 2013 when he was named interim Chair and CEO.

(3) In lieu of a sign-on cash bonus and to incentivize future performance, Mr. Austrian was awarded two grants of restricted shares of the company’s

common stock on May 23, 2011. The first grant of 600,000 restricted shares is subject to vesting based on a service requirement, and the second grant

of 600,000 restricted shares is subject to vesting based on both service and performance requirements, as further described under the “Summary of

Executive Agreements and Potential Payments Upon Termination or Change in Control.”

(4) Represents stock options granted to Mr. Newman on August 27, 2008 under the 2007 LTIP as part of his sign-on with the company. These options

vest in three equal installments beginning on the first anniversary of the grant date.

(5) Represents an annual grant of stock options awarded on March 4, 2009 under the 2007 LTIP. 50% of the grant consisted of at-the-money options and

50% consisted of premium-priced options. The options vest in three equal installments beginning on the first anniversary of the grant date.

73