Office Depot 2011 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

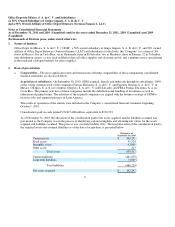

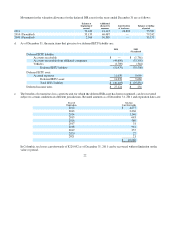

The Company amortizes the cost of its intangible assets with definite useful lives over such estimated useful lives. These

lives are reviewed at least annually to determine whether events and circumstances warrant a revision. Useful lives are as

follows:

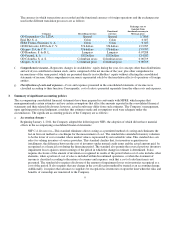

Revenue is recognized at the point of sale for retail transactions and at the time of successful delivery for contract, catalog

and internet sales. Sales taxes collected are not included in reported sales. The Company does not charge shipping and

handling costs to its customers; such costs are included within selling, administrative and general expenses within the

consolidated statements of income and amounted to $105,389, $101,803 and $ 93,002 in 2011, 2010 (unaudited) and 2009

(unaudited), respectively.

12

Years

Customer list

5

Non-com

p

ete a

g

reement

10

i.

P

rovisions

—

Provisions are recognized for current obligations that arise from a past event, that are probable to result in the

use of economic resources, and that can be reasonabl

y

estimated.

j

.

D

irect employee benefits

—

Direct employee benefits are calculated based on the services rendered by employees,

considering their most recent salaries. The liability is recognized as it accrues. These benefits include mainly statutory

em

p

lo

y

ee

p

rofit sharin

g

(“PTU”)

p

a

y

able, com

p

ensated absences, such as vacation and vacation

p

remiums, and incentives.

k.

E

mployee benefits from termination, retirement and othe

r

—

Liabilities from seniority premiums and, severance payments

are recognized as they accrue and are calculated by independent actuaries based on te projected unit credit method using

nominal interest rates.

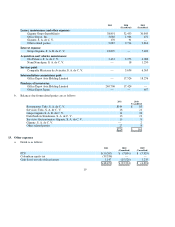

l. Statutory employee profit sharing (PTU)

—

PTU is recorded in the results of the year in which it is incurred and presented

under other income and expenses in the accompanying consolidated statements of income. Deferred PTU is derived from

temporary differences that result from comparing the accounting and tax bases of assets and liabilities and is recognized

only when it can be reasonably assumed that such difference will generate a liability or benefit, and there is no indication

that circumstances will chan

g

e in such a wa

y

that the liabilities will not be

p

aid or benefits will not be realized.

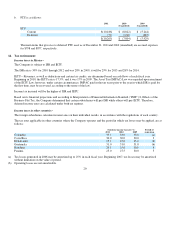

m.

I

ncome taxes

—

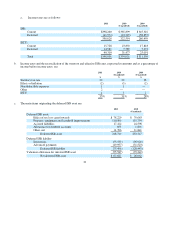

Income tax (“ISR”) and the Business Flat Tax (“IETU”) are recorded in the results of the year they are

incurred. To recognize deferred income taxes, based on its financial projections, the Company determines whether it

expects to incur ISR or IETU and, accordingly, recognizes deferred taxes based on that expectation. Deferred taxes are

calculated by applying the corresponding tax rate to temporary differences resulting from comparing the accounting and

tax bases of assets and liabilities and including, if any, future benefits from tax loss carryforwards and certain tax credits.

Deferred tax assets are recorded onl

y

when there is a hi

g

h

p

robabilit

y

of recover

y

.

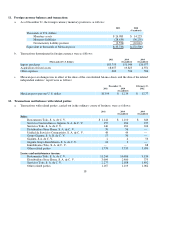

n.

F

oreign currency transactions

—

Foreign currency transactions are recorded at the applicable exchange rate in effect at the

transaction date. Monetary assets and liabilities denominated in foreign currency are translated into functional currency

amounts at the applicable exchange rate in effect at the balance sheet date. Exchange fluctuations are recorded as a

com

p

onent of net com

p

rehensive financin

g

cost in the consolidated statements of income.

o.

R

evenue recognition

—

Revenues are recognized in the period in which the risks and rewards of ownership of the

inventories are transferred to the customers, which generally coincides with the delivery of products to customers in

satisfaction of orders.