Office Depot 2011 Annual Report Download - page 233

Download and view the complete annual report

Please find page 233 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

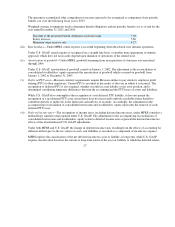

The accompanying consolidated financial statements of the Company are prepared in accordance with MFRS, which may vary

in certain significant respects from U.S. GAAP. Note 3 to the accompanying consolidated financial statements summarizes the

accounting policies adopted by the Company. The principal differences between MFRS and U.S. GAAP as they affect the

Company’s consolidated net income, consolidated stockholders’ equity, presentation of consolidated financial information and

the relevant disclosures are summarized below:

25

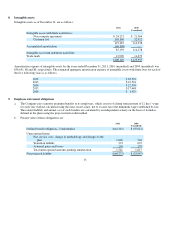

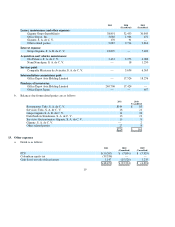

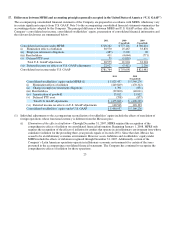

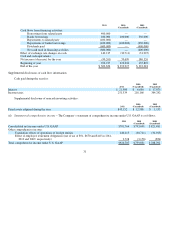

17. Differences between MFRS and accounting principles generally accepted in the United States of America (“U.S. GAA

P

”)

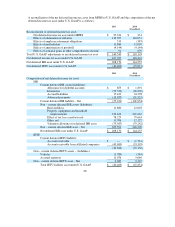

2011 2010 2009

(Unaudited) (Unaudited)

Consolidated net income under MFRS

$728,262

$777,116

$786,024

(i) Elimination effects of inflation

30,57

0

25,467

33,876

(ii) Em

p

lo

y

ee retirement obli

g

ations

(485)

2,209

96

(iii) Rent holida

y

s

411 (4,664)

(771)

(v) Deferred PTU asset

79 (1,018)

—

Total U.S. GAAP ad

j

ustments

30,575

21,994

33,201

(vi) Deferred income tax effects on U.S. GAAP ad

j

ustments

22,927

(5,412)

2,256

Consolidated net income under U.S. GAAP

$781,764

$ 793,698

$ 821,481

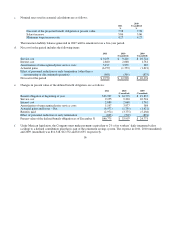

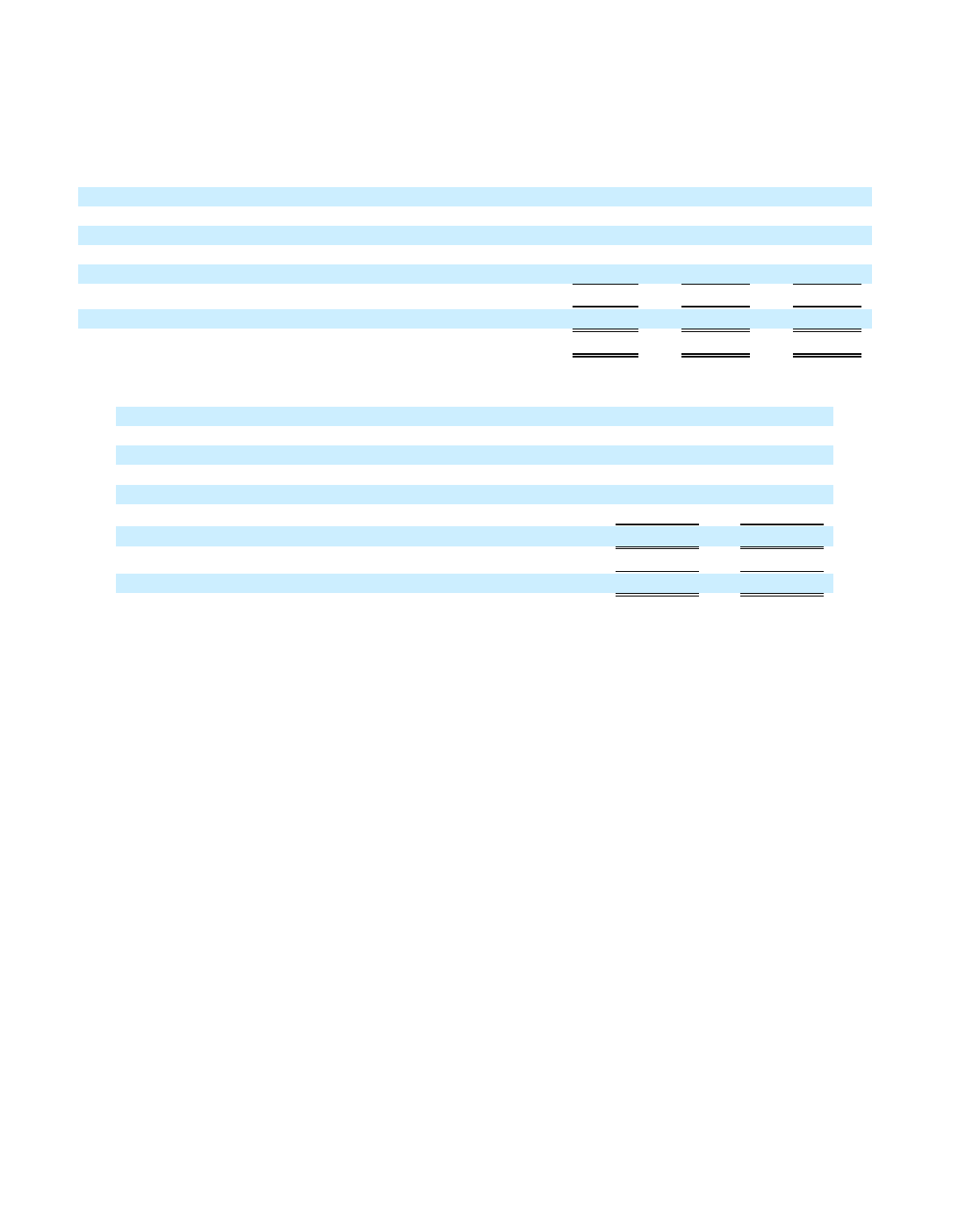

2011 2010

(Unaudited)

Consolidated stockholders’ e

q

uit

y

under MFRS (1)

$5,825,437

$5,546,276

(i) Elimination effects of inflation

(449,849)

(470,312)

(ii) Chan

g

e in em

p

lo

y

ee retirement obli

g

ations

1,392

(851)

(iii) Rent holida

y

s

(39,600)

(40,011)

(iv) Amortization of

g

oodwill

13,812

13,812

(v) Deferred PTU asset

(798)

(877)

Total U.S. GAAP ad

j

ustments

$(475,043)

$(498,239)

(vi) Deferred income tax effects on U.S. GAAP ad

j

ustments

140,543

118,193

Consolidated stockholders’ e

q

uit

y

under U.S. GAAP

$5,490,937

$5,166,230

(1) Individual adjustments to the accompanying reconciliation of stockholders’ equity include the effects of translation of

forei

g

n o

p

erations whose functional currenc

y

is different from the Mexican

p

eso.

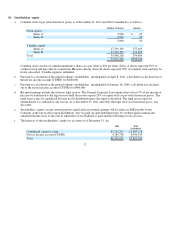

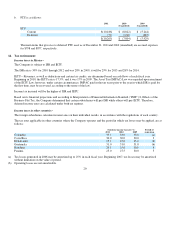

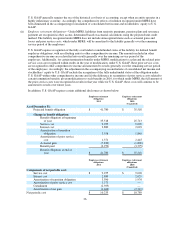

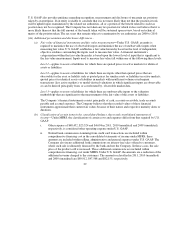

(i)

E

limination of the effects of inflation

—

Through December 31, 2007, MFRS required the recognition of the

comprehensive effects of inflation on consolidated financial information. Beginning January 1, 2008, MFRS only

requires the recognition of the effects of inflation for entities that operate in an inflationary environment (one whose

cumulative inflation for the preceding three-year periods equals or exceeds 26%). Since that date, Mexico has

ceased to be an inflationary economic environment. However assets, liabilities and stockholders’ equity under

MFRS include the effects of inflation recognized through December 31, 2007. Additionally, certain of the

Company’s Latin American operations operate in inflationary economic environments for certain of the years

presented in the accompanying consolidated financial statements. The Company has continued to recognize the

com

p

rehensive effects of inflation for those o

p

erations.