Office Depot 2011 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

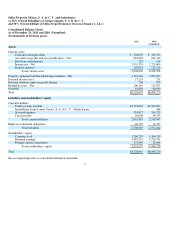

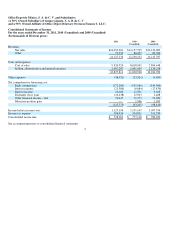

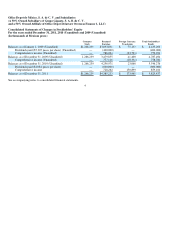

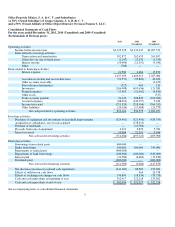

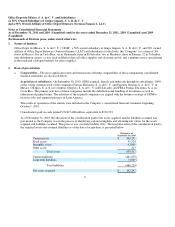

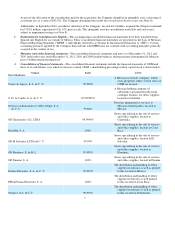

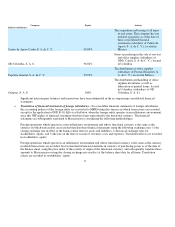

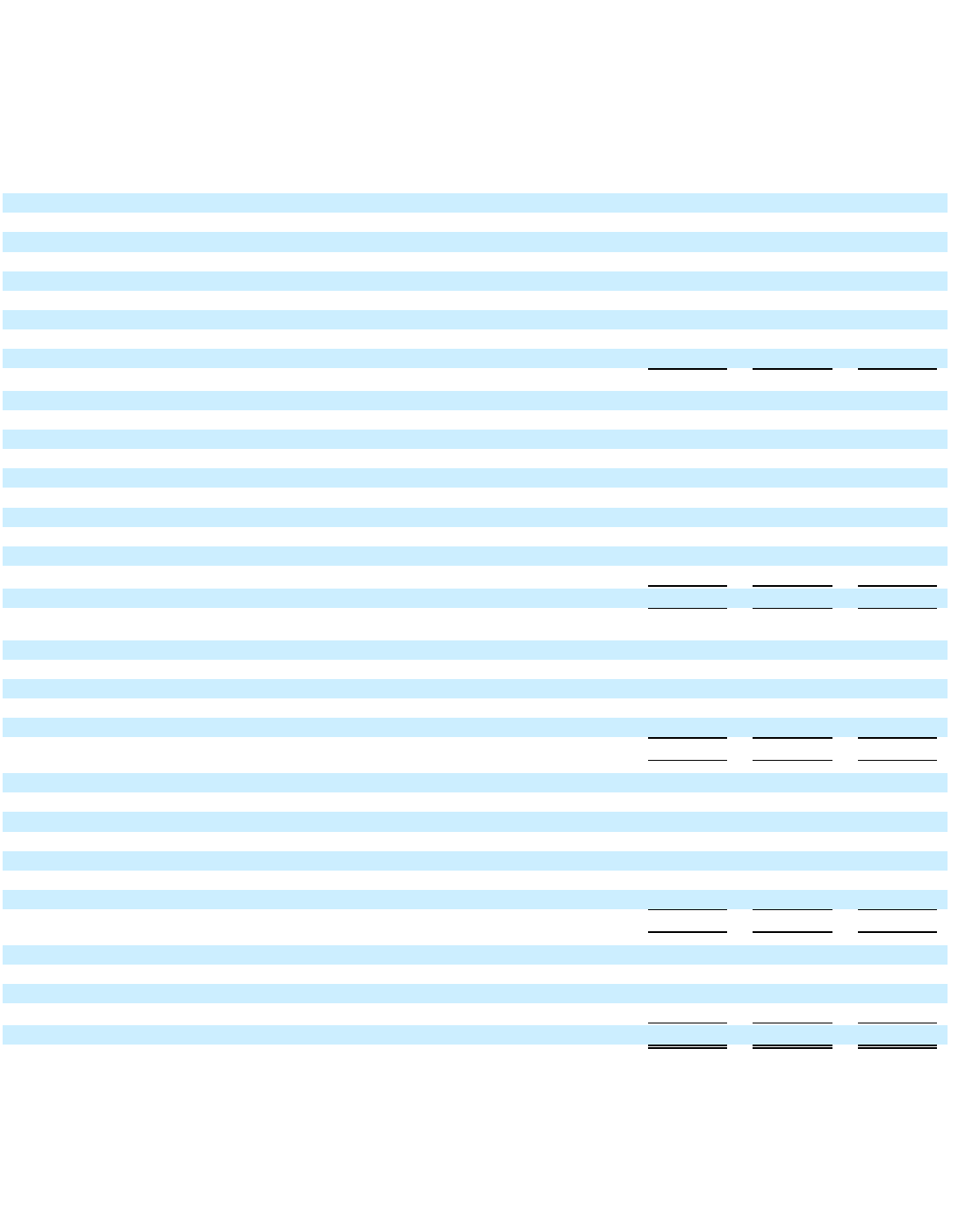

Office Depot de México, S. A. de C. V. and Subsidiaries

(A 50% Owned Subsidiary of Grupo Gigante, S. A. B. de C. V.

and a 50% Owned Affiliate of Office Depot Delaware Overseas Finance 1, LLC)

Consolidated Statements of Cash Flows

For the years ended December 31, 2011, 2010 (Unaudited) and 2009 (Unaudited)

(In thousands of Mexican pesos)

See accompanying notes to consolidated financial statements.

5

2011 2010 2009

(Unaudited) (Unaudited)

O

p

eratin

g

activities:

Income before income taxes

$1,125,198

$1,131,147

$1,097,574

Items related to investin

g

activities:

De

p

reciation and amortization

302,872

262,653

261,897

(Gain) loss on sale of fixed assets

(1,147)

15,520

(1,235)

Interest income

(10,486)

(12,391)

(9,106)

Other

(708)

—

—

Items related to financin

g

activities:

Interest ex

p

ense

21,580

6,684

17,870

1,437,309

1,403,613

1,367,000

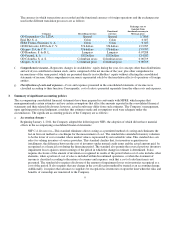

Accounts receivable and recoverable taxes

(51,571)

(95,802)

26,639

Other accounts receivable

—

—

(4,459)

Due to/from related

p

arties

(527)

463

131

Inventories

(204,088)

(495,636)

121,389

Pre

p

aid ex

p

enses

17,365

(51,692)

(4,835)

Other assets

—

—

(517)

Trade accounts

p

a

y

able

54,145

208,820

(103,090)

Accrued ex

p

enses

(88,054)

(143,557)

5,220

Income taxes

p

aid

(251,339)

(218,166)

(364,242)

Other liabilities

(20,136)

(17,468)

(21,779)

Net cash

p

rovided b

y

o

p

eratin

g

activities

893,104

590,575

1,021,457

Investin

g

activities:

Purchases of e

q

ui

p

ment and investments in leasehold im

p

rovements

(529,491)

(321,450)

(424,793)

Ac

q

uisition of subsidiaries, net of cash ac

q

uired

—

(178,353)

—

Purchase of trademar

k

—

(10,786)

—

Proceeds from sale of e

q

ui

p

ment

6,321

2,876

5,781

Interest received

10,486

12,391

9,106

Net cash used in investin

g

activities

(512,684)

(495,322)

(409,906)

Financin

g

activities:

Borrowin

g

s from related

p

art

y

400,000

—

—

Banks borrowin

g

s

100,000

100,000

330,000

Re

p

a

y

ments to related

p

art

y

(400,000)

—

—

Re

p

a

y

ments of bank borrowin

g

s

(100,000)

(100,000)

(330,000)

Interest

p

aid

(21,580)

(6,684)

(17,870)

Dividends

p

aid

(600,000)

—

(400,000)

Net cash used in financin

g

activities

(621,580)

(6,684)

(417,870)

Net (decrease) increase in cash and cash e

q

uivalents

(241,160)

88,569

193,681

Effects of inflation on cash flows

—

464

26,378

Effects of exchan

g

e rate chan

g

es on cash flows

150,899

(18,334)

(33,733)

Cash and cash e

q

uivalents at be

g

innin

g

of

y

ear

392,917

322,218

135,892

Cash and cash e

q

uivalents at end of

y

ear

$302,656

$392,917

$322,218