Office Depot 2011 Annual Report Download - page 63

Download and view the complete annual report

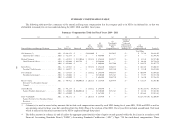

Please find page 63 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.reviews data gathered from Peer Group proxies as well as survey data from Hay Group for benchmarking

purposes. Data from Proxy Statements and Hay Group’s retail industry survey provide specific Peer Group NEO

information concerning base salaries, bonuses, long-term incentives, and benefit/perquisite prevalence. However,

the Peer Group and Hay Group survey data are not used in isolation. NEO compensation also takes into

consideration the company’s financial performance and the financial performance of the Peer Group. This

information is then used to analyze each NEO’s individual performance and tenure in his/her current position.

After a review of the benchmarking data and the other factors mentioned, the Compensation Committee

determines any changes to the NEO compensation positioning, target total direct compensation structures (i.e.,

sum of salary, annual bonus, and equity awards), variable compensation program design, and/or benefit and

perquisite offerings, if necessary. When making compensation decisions, the Compensation Committee considers

each element of compensation individually, but also considers the target total direct compensation as well as the

mix of compensation paid to the NEOs.

The Compensation Committee has developed specific criteria to select the company’s Peer Group and reviews

the criteria annually to determine if modifications are necessary. The guiding criteria used in 2011 were the same

as 2010 and included, but were not limited to: companies with revenues within one half to two times the

company’s revenue, a retail or direct to customer business model, a business to business model, significant global

operations, and a significant distribution function. Companies selected for the Peer Group were required to have

a number of these characteristics, but not all of them.

For 2011, no changes were made to the company’s 2010 Peer Group, which consisted of the following nineteen

organizations:

• Amazon.com • J.C. Penney Co., Inc. • Starbucks Corporation

• Arrow Electronics, Inc. • Kohl’s Corporation • Tech Data Corporation

• Avnet, Inc. • Limited Brands, Inc. • TJX Companies, Inc.

• Best Buy Co., Inc. • Macy’s, Inc. • W.W. Grainger

• GameStop • OfficeMax Inc. • Yum! Brands, Inc.

• Gap Inc. • Rite Aid Corporation

• Genuine Parts Company • Staples, Inc.

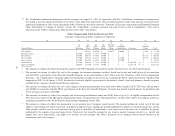

Aligning Executive Compensation with Shareholder Interests

The Compensation Committee believes there should be a key link between compensation and shareholder

interests. The Compensation Committee recognizes that shareholder interests are protected when the company

pays the NEOs competitively, but not in excess of market, relative to competitive benchmarks such as the

company’s Peer Group and applicable survey data. When designing the compensation program, the

Compensation Committee strives to provide an appropriate mix of different compensation elements, including

short-term and long-term, fixed and variable, and cash and equity components, and to provide smaller rewards

for short-term performance and larger rewards for long-term performance. The Compensation Committee also

designs the compensation program to provide meaningful rewards to the NEOs which align with the short-term

and long-term objectives of the company without encouraging undue risk taking.

NEOs receive their short-term, fixed, cash component in base salary, their short-term, variable, cash component

under the annual cash bonus plan, and their long-term variable equity and cash components under the long-term

incentive plan. Cash payments reward short-term and long-term performance, while equity rewards encourage

our NEOs to deliver results over a longer period of time and serve as a retention tool. For fiscal year 2012, the

cash payment under the long-term incentive program will also serve as a retention tool and the performance-

based equity awards will align NEOs interests with those of stockholders. The Compensation Committee believes

that a portion of NEO compensation should be at risk by basing it on the company’s operating and stock price

performance over the long term, which disincentivizes taking excessive short-term risks which may negatively

impact long-term performance. In establishing the total compensation package, at least half of total target

61