Office Depot 2011 Annual Report Download - page 228

Download and view the complete annual report

Please find page 228 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

|

|

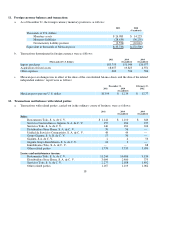

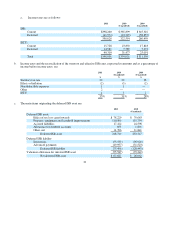

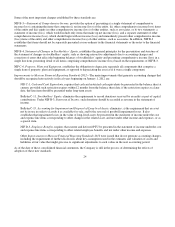

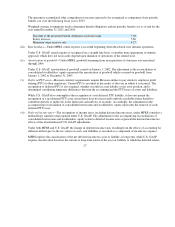

The main items that give rise to deferred PTU asset as of December 31, 2011and 2010 (unaudited) are accrued expenses

for $798 and $877, respectively.

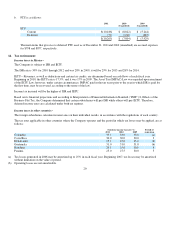

Income taxes in Mexico -

The Company is subject to ISR and IETU.

The ISR rate is 30% for 2010 through 2012 and was 28% in 2009; it will be 29% for 2013 and 28% for 2014.

IETU—Revenues, as well as deductions and certain tax credits, are determined based on cash flows of each fiscal year.

Beginning in 2010, the IETU rate is 17.5%, and it was 17% in 2009. The Asset Tax (IMPAC) Law was repealed upon enactment

of the IETU Law; however, under certain circumstances, IMPAC paid in the ten years prior to the year in which ISR is paid for

the first time, may be recovered, according to the terms of the law.

Income tax incurred will be the higher of ISR and IETU.

Based on its financial projections and according to Interpretation of Financial Information Standard (“INIF”) 8, Effects of the

Business Flat Tax, the Company determined that certain subsidiaries will pay ISR while others will pay IETU. Therefore,

deferred income taxes are calculated under both tax regimes.

Income taxes in other countries -

The foreign subsidiaries calculate income taxes on their individual results, in accordance with the regulations of each country.

The tax rates applicable in other countries where the Company operates and the period in which tax losses may be applied, are as

follows:

20

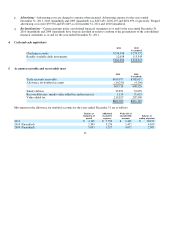

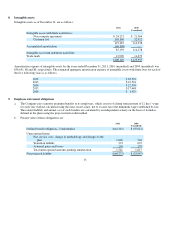

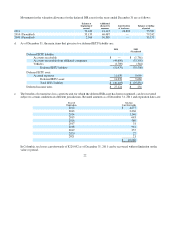

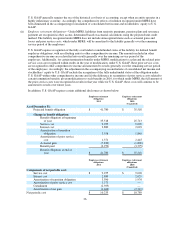

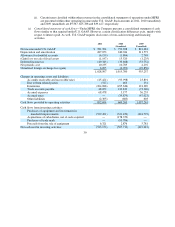

b. PTU is as follows:

2011 2010 2009

(Unaudited) (Unaudited)

PTU:

Current

$(10,186)

$ (8,822)

$ (5,244)

Deferred

(79)

1,018

(685)

$(10,265)

$ (7,804)

$ (5,929)

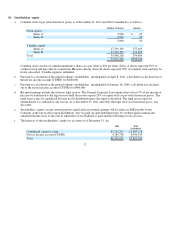

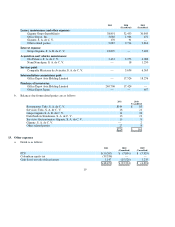

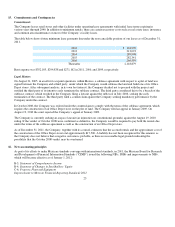

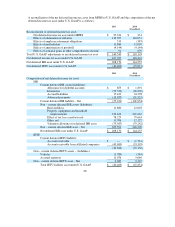

14. Tax environment

Statutory income tax rate (%)

Period of

2011 2010 2009 expiration

Colombia

33.0

33.0

33.0

(

a

)

Costa Rica

30.0

30.0

30.0

3

El Salvador

25.0

25.0

25.0

(b)

Guatemala

31.0

31.0

31.0

(b)

Honduras

35.0

35.0

30.0

4

Panama

25.0

27.5

30.0

5

(a) Tax losses generated in 2006 may be amortized up to 25% in each fiscal year. Beginning 2007, tax losses may be amortized

without limitation on the value or

p

eriod.

(b) O

p

eratin

g

losses are not amortizable.