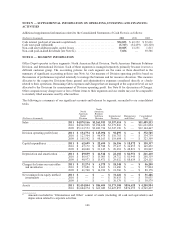

Office Depot 2011 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

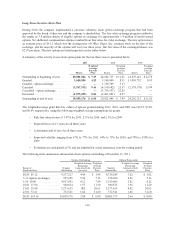

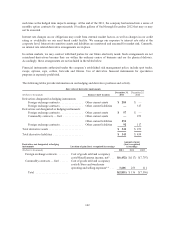

Long-Term Incentive Stock Plan

During 2010, the company implemented a one-time voluntary stock option exchange program that had been

approved by the board of directors and the company’s shareholders. The fair value exchange program resulted in

the tender of 3.8 million shares of eligible options in exchange for approximately 1.4 million of newly-issued

options. No additional compensation expense resulted from this value-for-value exchange. The new options have

an exercise price of $5.13, which was the closing price of Office Depot, Inc. common stock on the date of the

exchange, and the majority of the options will vest over three years. The fair value of the exchanged shares was

$2.97 per share. The new options are listed separately in the tables below.

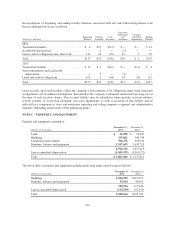

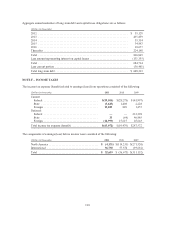

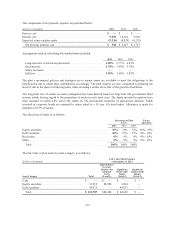

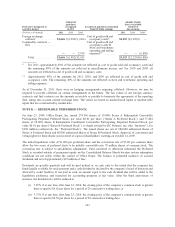

A summary of the activity in our stock option plans for the last three years is presented below.

2011 2010 2009

Shares

Weighted

Average

Exercise

Price Shares

Weighted

Average

Exercise

Price Shares

Weighted

Average

Exercise

Price

Outstanding at beginning of year ...... 20,021,044 $ 7.49 24,202,715 $ 11.81 14,479,141 $ 22.78

Granted .......................... 3,680,850 4.53 5,140,900 8.11 11,901,752 0.93

Granted – option exchange ........... ——1,350,709 5.13 — —

Canceled ......................... (3,567,513) 9.46 (4,510,682) 21.57 (2,178,178) 15.99

Cancelled – option exchange .......... ——(3,739,557) 22.85 — —

Exercised ......................... (1,075,205) 0.86 (2,423,041) 0.95 — —

Outstanding at end of year ........... 19,059,176 $ 6.90 20,021,044 $ 7.49 24,202,715 $ 11.81

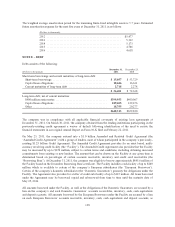

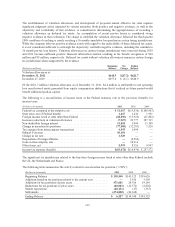

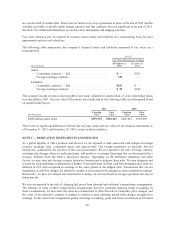

The weighted-average grant date fair values of options granted during 2011, 2010, and 2009 were $2.25, $3.89,

and $0.69, respectively, using the following weighted average assumptions for grants:

• Risk-free interest rates of 1.97% for 2011, 2.3% for 2010, and 2.1% for 2009

• Expected lives of 4.5 years for all three years

• A dividend yield of zero for all three years

• Expected volatility ranging from 67% to 77% for 2011, 64% to 73% for 2010, and 70% to 118% for

2009

• Forfeitures are anticipated at 5% and are adjusted for actual experience over the vesting period

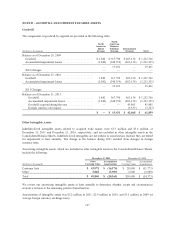

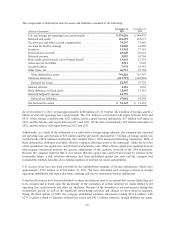

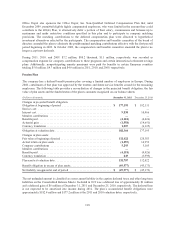

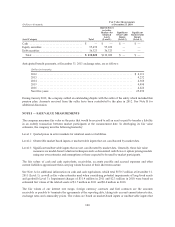

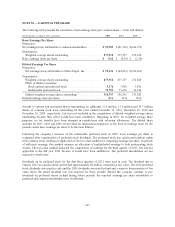

The following table summarizes information about options outstanding at December 31, 2011.

Options Outstanding Options Exercisable

Range of

Exercise Prices

Number

Outstanding

Weighted Average

Remaining

Contractual Life

(in years)

Weighted

Average

Exercise

Price

Number

Exercisable

Weighted Average

Remaining

Contractual Life

(in years)

Weighted

Average

Exercise

Price

$0.85 $5.12 .............. 9,537,217 4.49 $ 1.94 4,319,249 3.62 $ 1.02

5.13 (option exchange) ...... 995,256 5.04 5.13 374,020 4.56 5.13

5.14 10.00 ............... 4,917,893 4.12 7.80 2,519,605 2.81 8.12

10.01 15.00 .............. 960,634 1.97 11.30 940,525 1.96 11.29

15.01 25.00 .............. 2,275,635 .082 20.63 2,275,635 0.82 20.63

25.01 33.61 .............. 372,541 1.66 31.60 372,541 1.66 31.60

$0.85 $33.61 ............. 19,059,176 3.80 $ 6.90 10,801,575 2.66 $ 8.90

136