Office Depot 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

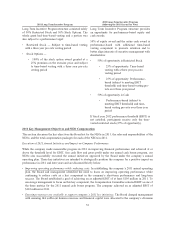

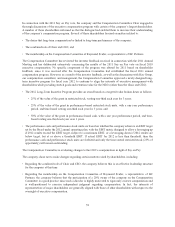

2011 Long-Term Incentive Program

2012 Long-Term Incentive Program

(following the 2011 Say on Pay Vote)

Long Term Incentive Program structure consisted solely

of 50% Restricted Stock and 50% Stock Options. The

whole grant had time-based vesting and a portion was

also subject to a performance target:

• Restricted Stock — Subject to time-based vesting

with a three year pro-rata vesting period

• Stock Options —

• 100% of the stock option award granted at a

25% premium on the exercise price and subject

to time-based vesting with a three year pro-rata

vesting period

Long Term Incentive Program structure provides

an opportunity for performance-based equity and

cash awards.

50% of equity award and the entire cash award is

performance-based with additional time-based

vesting component to promote retention and to

better align interests of executive management with

shareholders:

• 50% of opportunity is Restricted Stock

• 25% of opportunity: Time-based

vesting with a three year pro-rata

vesting period

• 25% of opportunity: Performance-

based (subject to meeting EBIT

threshold) and time-based vesting pro-

rata over three year period

• 50% of opportunity is Cash

• Performance-based (subject to

meeting EBIT threshold) and time-

based vesting pro-rata over three year

period

If fiscal year 2012 performance threshold (EBIT) is

not satisfied, participants receive only the time-

vested restricted stock (25% of opportunity).

2011 Key Management Objectives and NEO Compensation

This section discusses the key objectives the Board set for the NEOs in 2011, the roles and responsibilities of the

NEOs, and the total compensation packages for each of the NEOs in 2011.

Execution of 2011 Annual Initiatives and Impact on Company Performance

While the company made measurable progress in 2011 in improving financial performance and achieved at or

above the threshold level for EBIT, free cash flow and gross profit under our annual cash bonus program, our

NEOs also successfully executed the annual initiatives approved by the Board under the company’s annual

operating plan. These key initiatives are intended to strategically position the company for a positive impact on

performance in 2011 and later years and are discussed briefly below:

•Improving operating performance while reducing costs. In establishing the company’s 2011 annual operating

plan, the Board and management identified the need to focus on improving operating performance while

continuing to reduce costs as a key component in the company’s short-term performance and long-term

success. The Board established a goal of achieving an as adjusted EBIT of at least $105 million in 2011. To

encourage management to focus on this key component, the Compensation Committee selected EBIT as one of

the three metrics for the 2011 annual cash bonus program. The company achieved an as adjusted EBIT of

$122 million in 2011.

•Ensuring resources are available to support company’s 2011 key initiatives. The Board charged management

with ensuring that sufficient human resources and financial capital were allocated to the company’s divisions

52