Office Depot 2011 Annual Report Download - page 237

Download and view the complete annual report

Please find page 237 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

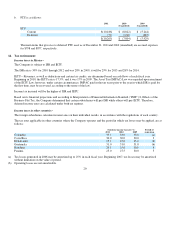

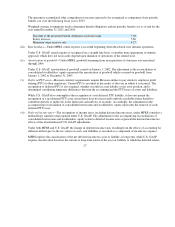

U.S. GAAP also provides guidance regarding recognition, measurement and disclosure of uncertain tax positions

taken by an enterprise. If an entity is unable to conclude that it is not more likely than not that the position it took

will be upheld upon examination by the related tax authorities, all or a portion of the benefit related to such tax

position may not be recognized. The Company has not taken any tax position for which it does not believe that it is

more likely than not that the full amount of the benefit taken will be sustained upon review, based on technical

merits of the position taken. The tax years that remain subject to examination by tax authorities are 2000 to 2010.

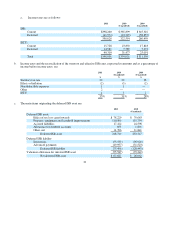

Level 1—applies to assets or liabilities for which there are quoted prices in active markets for identical

assets or liabilities.

Level 2—applies to assets or liabilities for which there are inputs other than quoted prices that are

observable for the asset or liability such as quoted prices for similar assets or liabilities in active markets;

quoted prices for identical assets or liabilities in markets with insufficient volume or infrequent

transactions (less active markets); or model-derived valuations in which significant inputs are observable

or can be derived principally from, or corroborated by, observable market data.

Level 3—applies to assets or liabilities for which there are unobservable inputs to the valuation

methodology that are significant to the measurement of the fair value of the assets or liabilities.

The Company’s financial instruments consist principally of cash, accounts receivable, trade accounts

payable and accrued expenses. The Company believes that the recorded values of these financial

instruments approximate their current fair values because of their nature and respective maturity dates or

durations.

29

(vii)

A

dditional presentation and disclosure differences -

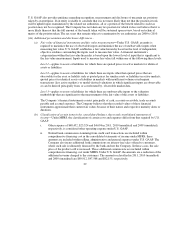

(a) Fair value of financial instruments and fair value measurements—Under U.S. GAAP, an entity is

required to maximize the use of observable inputs and minimize the use of unobservable inputs when

measuring fair value. U.S. GAAP establishes a fair value hierarchy based on the level of independent,

objective evidence surrounding the inputs used to measure fair value. A financial instrument’s

categorization within the fair value hierarchy is based upon the lowest level of input that is significant to

the fair value measurement. In

p

uts used to measure fair value fall within one of the followin

g

three levels:

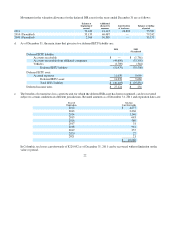

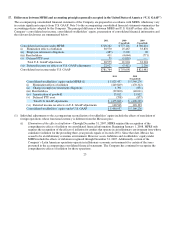

(b) Classification of certain items in the consolidated balance sheets and consolidated statements of

income—Under MFRS, the classification of certain costs and expenses differ from that required by U.S.

GAAP.

i. Other expense of $48,452, $23,324 and $4,694 in 2011, 2010 (unaudited) and 2009 (unaudited),

res

p

ectivel

y

, is considered other o

p

eratin

g

ex

p

ense under U.S. GAAP.

ii. Normal bank commissions stemming from credit card transactions are included within

comprehensive financing cost in the consolidated statements of income under MFRS; these

amounts are included within selling, administrative and general expenses under U.S. GAAP. The

Company also incurs additional bank commissions on interest-free sales offered to customers,

where such sale is ultimately financed by the bank and not the Company. In those cases, the sale

price of the product sold is increased. Those additional commissions are included within

comprehensive financing cost under MFRS. Under U.S. GAAP, the amounts are a reduction of the

additional revenue charged to the customers. The amounts reclassified in 2011, 2010 (unaudited)

and 2009 (unaudited) are $89,912, $47,568 and $82,155, res

p

ectivel

y

.