Office Depot 2011 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

|

|

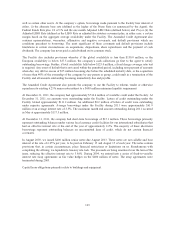

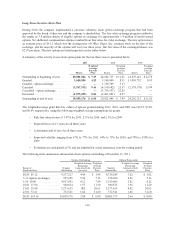

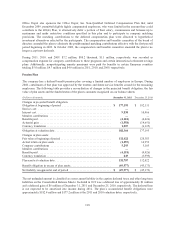

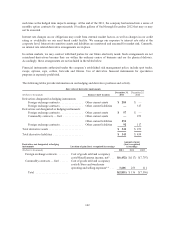

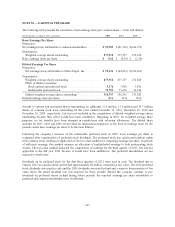

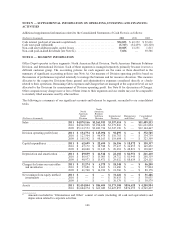

The components of net periodic expense are presented below:

(Dollars in thousands) 2011 2010 2009

Service cost ............................................... $—$—$—

Interest cost ............................................... 9,838 10,466 9,006

Expected return on plan assets ................................ (9,336) (8,039) (6,291)

Net periodic pension cost .................................. $ 502 $ 2,427 $ 2,715

Assumptions used in calculating the funded status included:

2011 2010 2009

Long-term rate of return on plan assets ....................... 6.00% 6.77% 6.89%

Discount rate ........................................... 4.70% 5.40% 5.70%

Salary increases ......................................... ———

Inflation ............................................... 3.00% 3.40% 3.80%

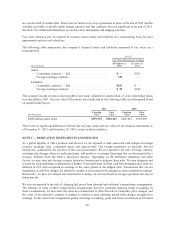

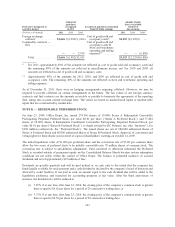

The plan’s investment policies and strategies are to ensure assets are available to meet the obligations to the

beneficiaries and to adjust plan contributions accordingly. The plan trustees are also committed to reducing the

level of risk in the plan over the long term, while retaining a return above that of the growth of liabilities.

The long-term rate of return on assets assumption has been derived based on long-term UK government fixed

income yields, having regard to the proportion of assets in each asset class. The funds invested in equities have

been assumed to return 4.0% above the return on UK government securities of appropriate duration. Funds

invested in corporate bonds are assumed to return equal to a 15 year AA bond index. Allowance is made for

expenses of 0.5% of assets.

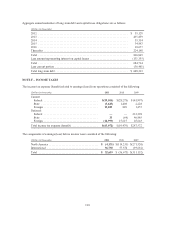

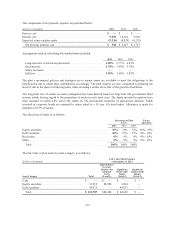

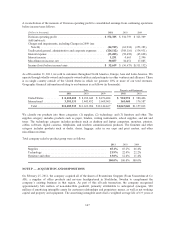

The allocation of assets is as follows:

Percentage of Plan

Assets

Target

Allocation

2011 2010 2009

Equity securities .............................................. 70% 73% 71% 60% - 95%

Debt securities ............................................... 30% 27% 27% 0% - 30%

Real estate ................................................... 0% 0% 0% 0% - 10%

Other ....................................................... 0% 0% 2% 0% - 10%

Total ..................................................... 100% 100% 100%

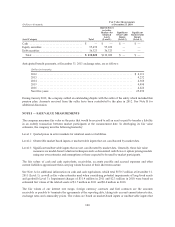

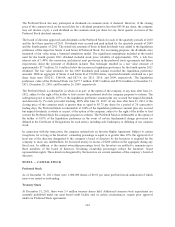

The fair value of plan assets by asset category is as follows:

(Dollars in thousands)

Fair Value Measurements

at December 31, 2011

Asset Category Total

Quoted Prices

in Active

Markets for

Identical

Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Cash ..................................... $ — $ — $ — $ —

Equity securities ............................ 91,912 88,088 3,824 —

Debt securities ............................. 40,875 — 40,875 —

Total ................................... $ 132,787 $88,088 $ 44,699 $ —

139