Office Depot 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

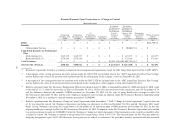

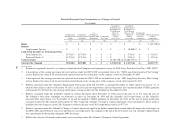

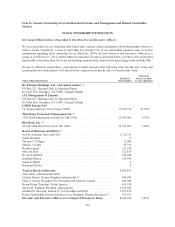

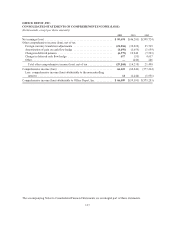

(1) Includes shares of common stock subject to options exercisable within 60 days of February 15, 2012, if

applicable, even though a considerable number of the options are underwater. See “Options Exercisable

within 60 days of Record Date” table below for detail. Also included are unvested shares of restricted stock,

as to which the holder has voting rights.

(2) Except for BC Partners Holdings, Ltd. and related entities (including CIE Management II Limited and

LMBO Europe SAS), applicable percentage of ownership for all Shareholders listed in the table above is

based on 280,853,676 shares of common stock outstanding as of February 15, 2012. In computing the

number of shares of common stock beneficially owned by a person and the percentage ownership of that

person, shares issuable upon the exercise of options that are exercisable within 60 days of February 15,

2012, are not deemed outstanding for purposes of computing the percentage of ownership of any other

person. Applicable percentage of ownership for BC Partners Holdings, Ltd. (including CIE Management II

Limited and LMBO Europe SAS) is based on 356,399,450 shares of common stock, which includes the

as-converted number of common shares underlying the shares of Series B Preferred owned by these entities,

which are now convertible into common stock.

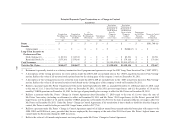

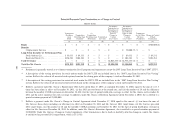

(3) The information regarding CIE Management II Limited, which we refer to as CIE, and LMBO Europe SAS,

which we refer to as LMBO was derived from a Schedule 13D filed on July 2, 2009, jointly by: (i) BC

European Capital VIII-1 to 12 (inclusive), each a United Kingdom limited partnership (“Funds 1-12”);

(ii) BC European Capital VIII-14 to 34 (inclusive), each a United Kingdom limited partnership (“Funds

14-34” and together with Funds 1-12, the “CIE Investors”); (iii) BC European Capital VIII-35 SC to 39 SC

(inclusive), each a Société Civiles organized under the laws of France (the “LMBO Investors” and together

with the CIE Investors, the “Investors”); (iv) LMBO; and (v) CIE on July 2, 2009. CIE is the general partner

of, and has investment control over the shares held by, each of the CIE Investors and LMBO is Gérant as to,

and has investment control over the shares held by, each of the LMBO Investors. BC Partners Holdings

Limited, a limited corporation organized under the laws of Guernsey, Channel Islands (“BCHL”), is the

controlling entity of each of (i) CIE; and (ii) LMBO. CIE, LMBO and BCHL are each managed by separate

boards of directors. A list of the directors of CIE, LMBO and BCHL is provided on Schedules II, III and IV

to the Schedule 13D filed on July 2, 2009 and none of those directors have beneficial ownership of the share

held by the Investors. Since CIE, LMBO and BCHL are managed by boards of directors, no individuals

have ultimate voting or investment control (as determined by Rule 13d-3) over the shares that may be

deemed beneficially owned by CIE and LMBO. We have no further information or knowledge about CIE,

LMBO or BCHL. The Investors, CIE and LMBO may be deemed to be a “group” (within the meaning of

Section 13(d)(3) of the Securities Exchange Act) and, as such, may be deemed to be beneficial owners of

(y) 274,596 shares of 10% Series A Redeemable Convertible Participating Perpetual Preferred Stock, par

value $0.01 per share and (z) 75,404 shares of 10% Series B Redeemable Conditional Convertible

Participating Perpetual Preferred Stock, par value $0.01 per share, of Office Depot, Inc., each Investor,

however, disclaims beneficial ownership with respect to the shares owned by each of the other Investors,

CIE and LMBO. None of the Investors own any shares of common stock over which it has sole voting,

disposition or investment power. The figures in the table set forth the number of shares of common stock, on

an as-converted basis, owned of record and beneficially owned by the funds including the as-converted

underlying shares of Series B Preferred owned by the funds, which are now convertible into common stock.

(4) The information regarding Thornburg Investment Management Inc. is reported as of December 31, 2011

and was derived from a Schedule 13G filed on February 3, 2012 that reported sole voting power over

25,985,069 shares, shared voting power over 0 shares, shared dispositive power over 0 shares and sole

dispositive power over 25,985,069 shares.

(5) The information regarding BlackRock, Inc. is reported as of December 30, 2011 and was derived from a

Schedule 13G filed on February 9, 2012 that reported sole voting power over 19,763,603 shares, shared

voting power over 0 shares, shared dispositive power over 0 shares and sole dispositive power over

19,763,603 shares.

107