Office Depot 2011 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

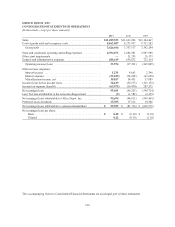

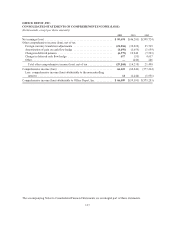

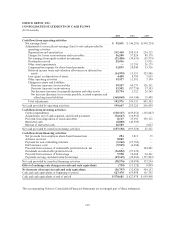

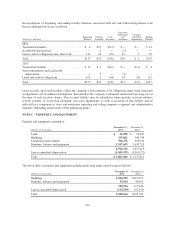

OFFICE DEPOT, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

2011 2010 2009

Cash flows from operating activities:

Net earnings (loss) ........................................... $ 95,691 $ (46,205) $(598,724)

Adjustments to reconcile net earnings (loss) to net cash provided by

operating activities: ........................................

Depreciation and amortization ................................ 211,410 208,319 224,115

Charges for losses on inventories and receivables ................. 56,200 57,824 80,178

Net earnings from equity method investments .................... (31,426) (30,635) (30,579)

Dividends received ......................................... 25,016 — 13,931

Other asset impairments ..................................... —51,295 26,175

Compensation expense for share-based payments ................. 13,895 20,840 33,316

Deferred income taxes and valuation allowances on deferred tax

assets .................................................. (14,999) 15,551 325,886

Loss (gain) on disposition of assets ............................ 4,420 8,709 7,655

Other operating activities .................................... 19,937 11,501 7,199

Changes in assets and liabilities: ..............................

Decrease (increase) in receivables ........................... 99,927 60,273 126,131

Decrease (increase) in inventories ........................... 53,902 (87,724) 37,583

Net decrease (increase) in prepaid expenses and other assets ...... 25,754 2,522 28,165

Net increase (decrease) in accounts payable, accrued expenses and

other long-term liabilities ................................ (360,060) (69,144) 15,408

Total adjustments .......................................... 103,976 249,331 895,163

Net cash provided by operating activities ........................... 199,667 203,126 296,439

Cash flows from investing activities:

Capital expenditures .......................................... (130,317) (169,452) (130,847)

Acquisitions, net of cash acquired, and related payments ............. (72,667) (10,952) —

Proceeds from disposition of assets and other ...................... 8,117 35,393 150,131

Restricted cash .............................................. (8,800) (46,509) —

Release of restricted cash ...................................... 46,509 — 6,037

Net cash provided by (used in) investing activities .................... (157,158) (191,520) 25,321

Cash flows from financing activities:

Net proceeds from employee share-based transactions ............... 254 1,011 35

Advance received ............................................ 8,800 ——

Payment for non-controlling interests ............................ (1,262) (21,786) —

Debt issuance costs ........................................... (9,945) (4,688) —

Proceeds from issuance of redeemable preferred stock, net ........... —— 324,801

Dividends on redeemable preferred stock ......................... (36,852) (27,639) —

Proceeds from issuance of borrowings ........................... 9,598 52,488 24,321

Payments on long- and short-term borrowings ..................... (69,169) (30,284) (175,863)

Net cash provided by (used in) financing activities .................... (98,576) (30,898) 173,294

Effect of exchange rate changes on cash and cash equivalents ........ (730) (13,128) 9,099

Net increase (decrease) in cash and cash equivalents ................ (56,797) (32,420) 504,153

Cash and cash equivalents at beginning of period ..................... 627,478 659,898 155,745

Cash and cash equivalents at end of period .......................... $ 570,681 $ 627,478 $ 659,898

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.

119