Office Depot 2011 Annual Report Download - page 126

Download and view the complete annual report

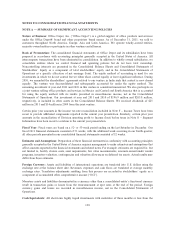

Please find page 126 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.on a straight-line basis over the requisite service period of the grant. We consider alternative models if grants

have characteristics that cannot be reasonably estimated using this model.

Pre-opening Expenses: Pre-opening expenses related to opening new stores and warehouses or relocating

existing stores and warehouses are expensed as incurred and included in store and warehouse operating and

selling expenses.

Self-Insurance: Office Depot is primarily self-insured for workers’ compensation, auto and general liability and

employee medical insurance programs. Self-insurance liabilities are based on claims filed and estimates of claims

incurred but not reported. These liabilities are not discounted.

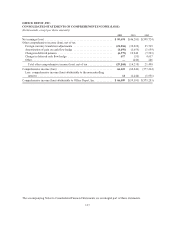

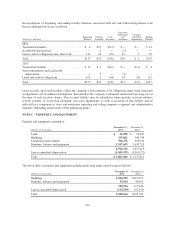

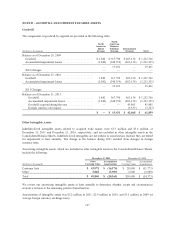

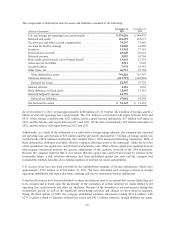

Comprehensive Income (Loss): Comprehensive income (loss) represents the change in stockholders’ equity

from transactions and other events and circumstances arising from non-stockholder sources. Comprehensive

income consists of net earnings (loss), foreign currency translation adjustments, deferred pension gains (losses),

and elements of qualifying cash flow hedges, net of applicable income taxes. As of December 31, 2011, and

December 25, 2010, our Consolidated Balance Sheet reflected accumulated OCI in the amount of $195 million

and $224 million, which consisted of $193 million and $214 million in foreign currency translation adjustments,

$3 million and $4 million in unamortized gain on hedge and $1 million in deferred pension loss and $6 million in

deferred pension gain, respectively.

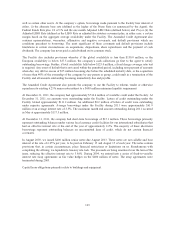

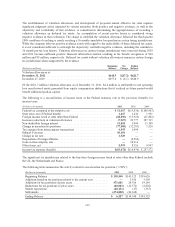

Vendor Arrangements: We enter into arrangements with substantially all of our significant vendors that provide

for some form of consideration to be received from the vendors. Arrangements vary, but some specify volume

rebate thresholds, advertising support levels, as well as terms for payment and other administrative matters. The

volume-based rebates, supported by a vendor agreement, are estimated throughout the year and reduce the cost of

inventory and cost of goods sold during the year. This estimate is regularly monitored and adjusted for current or

anticipated changes in purchase levels and for sales activity. Other promotional consideration received is event-

based or represents general support and is recognized as a reduction of cost of goods sold or inventory, as

appropriate based on the type of promotion and the agreement with the vendor. Some arrangements may meet the

specific, incremental, identifiable criteria that allow for direct operating expense offset, but such arrangements

are not significant.

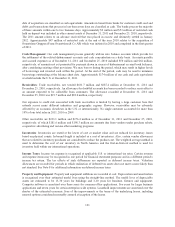

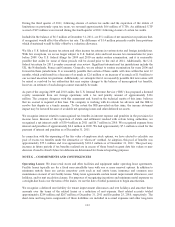

New Accounting Standards: Effective for the first quarter of 2012, a new accounting standard will require the

presentation of net income and other comprehensive income either as a continuous statement or as two separate

statements. The portion of the new standard which would require the presentation of reclassifications of other

comprehensive income on the face of the income statement has been deferred. In past periods, we have presented

the components of other comprehensive income as a separate statement for the full year and as a separate

footnote for interim periods. We anticipate following the two statement format. The standard will not change the

recognition or measurement of net income or other comprehensive income.

Also effective for the first quarter of 2012, a new accounting standard has been issued that is intended to achieve

common fair value measurements and disclosure requirements between U.S. generally accepted accounting

principles and International Financial Reporting Standards. This new standard amends current fair value

guidance to include increased transparency around valuation inputs and investment categorization.

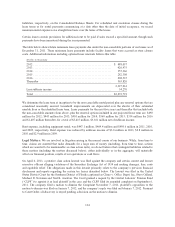

Effective for 2012 testing for goodwill impairment, entities will have an option of performing a qualitative

assessment before calculating the fair value of their reporting units. If, based on the qualitative assessment, an

entity concludes it is more likely than not that the fair value of the reporting unit exceeds its carrying value,

quantitative testing for impairment is not necessary. The company did not elect the early adoption that was

available for 2011.

Additionally, effective for the first quarter of 2014, a new accounting standard will require disclosure of

information about the effect or potential effect of financial instrument netting arrangements on the company’s

financial position. Companies will be required to present both net (offset amounts) and gross information in the

notes to the financial statements for relevant assets and liabilities that are offset.

124