Office Depot 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

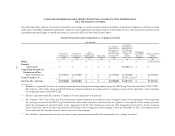

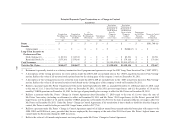

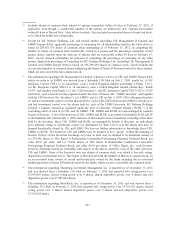

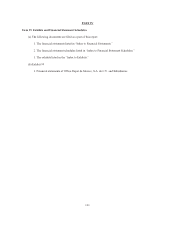

(1) In August 2011, Ms. Vanderlinde terminated her employment and, pursuant to a Separation Agreement with

the company dated September 1, 2011, received a total severance payment of $1,572,296.

(2) Represents a payment equal to 2 times Ms. Vanderlinde’s annual bonus at target pursuant to the terms of her

Separation Agreement.

(3) Represents the payment of COBRA and other welfare benefit plan monthly premiums pursuant to the terms

of Ms. Vanderlinde’s Separation Agreement.

(4) Under Ms. Vanderlinde’s Separation Agreement, she is eligible to receive a payment equal to 2 times the

sum of her base salary in effect on her termination date with the company.

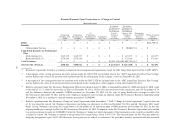

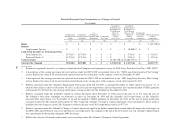

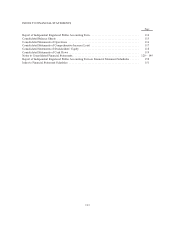

2007 Long Term Incentive Plan Vesting

Under the terms of the 2007 Long-Term Incentive Plan (“2007 LTIP”), upon termination from employment with

the company, an NEO’s stock options will vest and be exercisable as follows: If an NEO involuntarily terminates

employment with the company for any reason other than death, Disability, or Cause (as each is defined in the

2007 LTIP), or if an NEO voluntarily terminates employment with the company after completing at least five

(5) years of service with the company, the NEO’s unvested stock options will be immediately forfeited; and the

NEO’s vested stock options shall remain exercisable until the earlier of: eighteen (18) months (twelve

(12) months for new grants made on or after April 21, 2011) following the NEO’s separation date, or the

expiration date of the options. An NEO’s stock options will fully vest upon termination from the company as a

result of death or Disability and shall remain exercisable until the earlier of: twenty-four (24) months following

the NEO’s separation date, or the expiration of the options. An NEO’s stock options will fully vest upon

termination from the company as a result of Retirement (i.e., age 60 with 5 years of service with the company)

and shall remain exercisable until the earlier of: ninety (90) days following the NEO’s separation date, or the

expiration of the options. All of an NEO’s stock options, including any stock options which were previously

vested, will be immediately forfeited if the NEO is terminated by the company for Cause. If an NEO’s

termination from employment with the company does not satisfy one of these provisions, then the NEO’s

unvested stock options will be immediately forfeited and the vested stock options shall remain exercisable until

the earlier of: ninety (90) days following the NEO’s separation date, or the expiration date of the options.

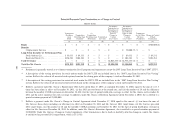

Under the terms of the 2007 LTIP, upon an NEO’s termination from employment with the company, the

applicable restriction period will lapse and an NEO’s restricted stock will vest as follows: An NEO’s restricted

stock based solely on the requirement to continue to perform services shall become fully vested: (i) immediately

prior to a Change in Control (as defined in the 2007 LTIP), (ii) as of the NEO’s date of death or Disability, or

(iii) as of the date the NEO has both attained age sixty and completed 5 years of continuous service with the

company regardless of whether the restricted stock was granted before or after the date the NEO satisfied the age

and service requirements. An NEO’s restricted stock that contains performance conditions as a requirement for

vesting shall vest: (i) pro-rata at target based on the amount of time that has elapsed from the beginning of the

performance cycle through the NEO’s date of death, Disability, or Retirement, and (ii) in full at target as of a

Change in Control. If an NEO is involuntarily terminated by the company for Cause or if the NEO’s termination

from employment does not satisfy one of the circumstances described above, all of the NEO’s restricted stock

will be automatically forfeited as of the date of termination.

105