Office Depot 2011 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

liabilities, respectively, on the Consolidated Balance Sheets. For scheduled rent escalation clauses during the

lease terms or for rental payments commencing at a date other than the date of initial occupancy, we record

minimum rental expenses on a straight-line basis over the terms of the leases.

Certain leases contain provisions for additional rent to be paid if sales exceed a specified amount, though such

payments have been immaterial during the years presented.

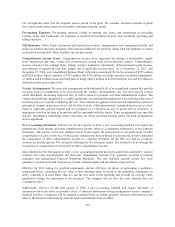

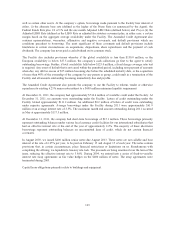

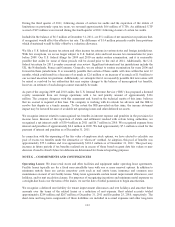

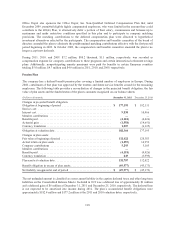

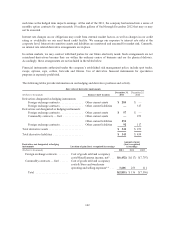

The table below shows future minimum lease payments due under the non-cancelable portions of our leases as of

December 31, 2011. These minimum lease payments include facility leases that were accrued as store closure

costs. Additional information including optional lease renewals follows this table.

(Dollars in thousands)

2012 ....................................................... $ 488,057

2013 ....................................................... 426,975

2014 ....................................................... 355,366

2015 ....................................................... 282,308

2016 ....................................................... 208,535

Thereafter .................................................. 565,820

2,327,061

Less sublease income ......................................... 54,270

Total ...................................................... $2,272,791

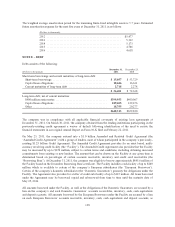

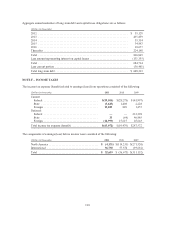

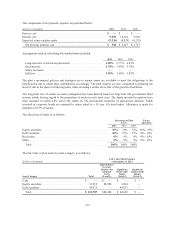

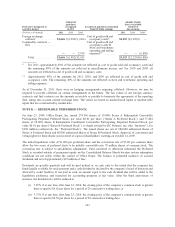

We determine the lease term at inception to be the non-cancelable rental period plus any renewal options that are

considered reasonably assured. Leasehold improvements are depreciated over the shorter of their estimated

useable lives or the identified lease term. Lease payments for the next five years and thereafter that include both

the non-cancelable amounts from above, plus the renewal options included in our projected lease term are, $490

million for 2012; $443 million for 2013; $401 million for 2014; $360 million for 2015; $314 million for 2016

and $1,407 million thereafter, for a total of $3,415 million, $3,361 million net of sublease income.

Rent expense, including equipment rental, was $447.1 million, $469.4 million and $498.6 million in 2011, 2010,

and 2009, respectively. Rent expense was reduced by sublease income of $3.0 million in 2011, $2.8 million in

2010 and $2.9 million in 2009.

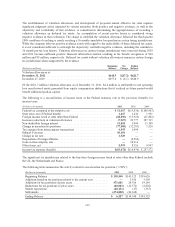

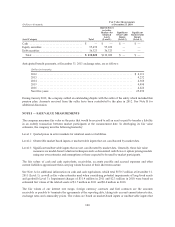

Legal Matters: We are involved in litigation arising in the normal course of our business. While, from time to

time, claims are asserted that make demands for a large sum of money (including, from time to time, actions

which are asserted to be maintainable as class action suits), we do not believe that contingent liabilities related to

these matters (including the matters discussed below), either individually or in the aggregate, will materially

affect our financial position, results of our operations or cash flows.

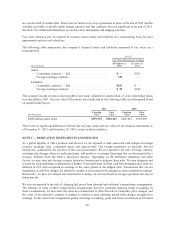

On April 6, 2011, a putative class action lawsuit was filed against the company and certain current and former

executive officers alleging violations of the Securities Exchange Act of 1934 and seeking damages, fees, costs

and equitable relief. The allegations made in this lawsuit primarily relate to the company’s previous financial

disclosures and reports regarding the certain tax losses described below. The lawsuit was filed in the United

States District Court for the Southern District of Florida captioned as Climo v. Office Depot, Inc, Steve Odland,

Michael D. Newman and Neil R. Austrian. The Court granted a request by the Central Laborers’ Pension Fund

(“CLPF”) to appoint it as lead plaintiff in the case and the CLPF filed its amended complaint on September 6,

2011. The company filed a motion to dismiss the Complaint November 7, 2011, plaintiff’s opposition to the

motion to dismiss was filed on January 7, 2012, and the company’s reply was filed on February 7, 2012. Pursuant

to Court Order, all discovery is stayed pending a decision on the motion to dismiss.

134