Office Depot 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

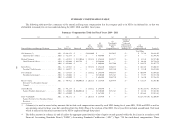

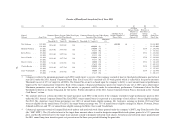

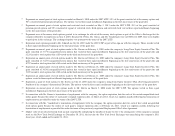

(10) Ms. Vanderlinde terminated employment with the company on August 31, 2011. In connection with Ms. Vanderlinde’s termination of employment,

she earned a severance payment pursuant to the terms of her Separation Agreement, which included amounts owed to her pursuant to her previously

negotiated Employment Offer Letter Agreement, both of which are described under the “Summary of Executive Agreements and Potential Payments

Upon Termination or Change of Control” section. Ms. Vanderlinde’s severance payment was paid to her in cash on September 7, 2011 and is

disclosed on the “Other Compensation Table for Fiscal Year 2011” that follows.

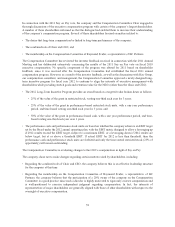

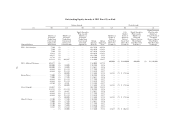

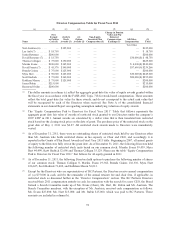

Other Compensation Table for Fiscal Year 2011

Summary Compensation Table, Column (i) Components

(a) (b) (c) (d) (e) (f) (g) (h) (i) (j)

Named Officers

(1)

Car

Allowance

(2)

Exec

Med

(3)

Exec

Welfare

(4)

401k

Match

(5)

Personal

Aircraft

Usage

(6)

Charitable

Contributions Severance

(9)

Company

Event Total

Neil Austrian ............................................... $ — $26,561 $10,340 $ — $18,879 $10,000 $ — $ 5,986 $ 71,766

Michael Newman ............................................ $15,900 $51,457 $ 8,877 $4,900 $ — $ — $ — $ — $ 81,134

Kevin Peters ................................................ $15,900 $60,393 $ 8,603 $4,900 $ — $ — $ — $11,973 $ 101,769

Steve Schmidt .............................................. $15,900 $49,710 $11,114 $4,900 $ — $12,500 $ — $11,973 $ 106,097

Elisa D. Garcia .............................................. $15,900 $61,144 $ 8,213 $4,900 $ — $25,000 $ — $ — $ 115,157

Charles Brown .............................................. $11,760 $46,166 $ 7,316 $4,900 $ — $ — $3,401,209 (7) $ — $3,471,351

Daisy Vanderlinde ........................................... $10,680 $33,140 $ 6,747 $4,900 $ — $ — $1,572,296 (8) $ — $1,627,763

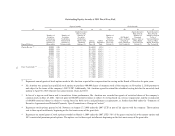

(1) The amounts in column (b) reflect the payments made to each NEO during fiscal year 2011 as part of the Executive Car Allowance Program.

(2) The amounts in column (c) reflect the cost to the company for insurance premiums (medical, dental and vision) and health physicals in connection

with the NEOs’ participation in the Executive Benefits Program. As discussed further in the CD&A under the “Summary of Key 2011 Compensation

Decisions,” the Compensation Committee approved terminating coverage of all executives, including the NEOs, under the Executive Medical Plan

beginning in 2012. As of January 1, 2012, the executives are now eligible to participate in the medical, dental, vision and pharmacy benefit programs

available to the company’s broad-based full-time employees.

(3) The amounts in column (d) reflect the cost to the company for insurance premiums associated with welfare benefits (LTD, STD, basic life insurance

and AD&D) in connection with the NEOs’ participation in the Executive Benefits Program. Amounts also include imputed income for premiums paid

on life insurance in excess of $50,000.

(4) The amounts in column (e) reflect the company cost of matching contributions under our 401(k) Plan of up to 2% of eligible compensation for the

2011 fiscal year subject to the IRS annual compensation limits. As discussed in the “Retirement Plans” section of the CD&A, the company restarted a

matching contribution to the 401(k) Plan for all participants beginning January 2011.

(5) The amount in column (f) reflects the incremental cost of personal use of company leased aircraft. The amount includes the actual cost of fuel and

additives, trip-related crew hotels and meals, in-flight food and beverages, landing and ground handling fees, hangar or aircraft parking costs, certain

other smaller variable costs for each personal trip leg plus an allocation of maintenance costs based on the per mile cost to maintain the planes

multiplied by the number of personal miles flown. Fixed costs that would be incurred in any event to operate company aircraft (e.g., aircraft and

hangar lease costs, depreciation, and flight crew salaries) are not included. Mr. Peters’ personal use of company leased aircraft resulted in no

incremental cost to the company.

68