Office Depot 2011 Annual Report Download - page 234

Download and view the complete annual report

Please find page 234 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

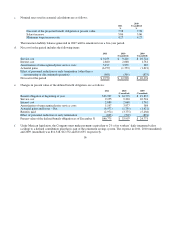

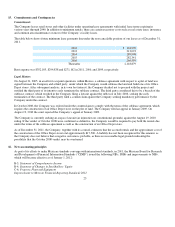

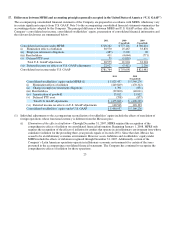

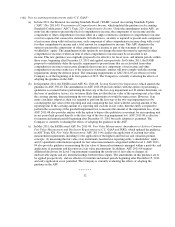

U.S. GAAP generally requires the use of the historical cost basis of accounting, except when an entity operates in a

highly inflationary economy. Accordingly, the comprehensive effects of inflation recognized under MFRS have

been eliminated in the accompanying reconciliation of consolidated net income and stockholders’ equity to U.S.

GAAP.

U.S. GAAP requires recognition of the fully overfunded or underfunded status of the liability for defined benefit

employee obligations, with an offsetting entry to other comprehensive income. The amounts included in other

comprehensive income are reclassified into results generally over the remaining service period of the

employees. Additionally, for certain termination benefits under MFRS, modifications to a plan and the related prior

service costs are recognized within results in the year of modification; under U.S. GAAP, these prior service costs

are recognized in other comprehensive income and amortized to results generally over the remaining service period

of the employees. Accordingly, the adjustment in the accompanying reconciliations of consolidated net income and

stockholders’ equity to U.S. GAAP include the recognition of the fully underfunded status of the obligation under

U.S. GAAP within other comprehensive income and (ii) the difference in recognition of prior service costs related to

certain termination benefits, given modifications to such benefits in 2010, for which under MFRS, the full amount o

f

the prior service costs were recognized in results in that year while for U.S. GAAP, these costs will continue to be

amortized to results over future years.

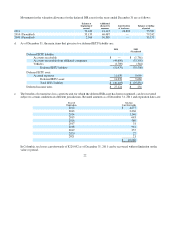

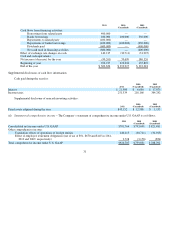

In addition, U.S. GAAP requires certain additional disclosures as shown below:

26

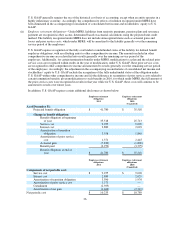

(ii)

E

mployee retirement obligations

—

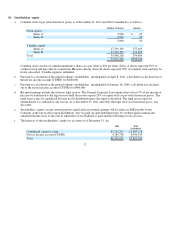

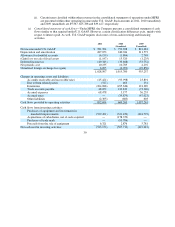

Under MFRS, liabilities from seniority premiums, pension plans and severance

payment are recognized as they accrue, determined based on actuarial calculations using the projected unit credit

method. The liability recognized under MFRS does not include unrecognized items such as actuarial gains and

losses and prior service costs, which under MFRS, will be amortized to the liability generally over the remaining

service

p

eriod of the em

p

lo

y

ees.

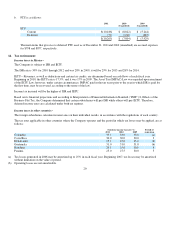

Employee retirement

obligations

2011

Employee retirement

obligations

2010

(Unaudited)

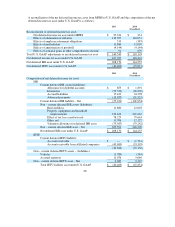

As of December 31:

Pro

j

ected benefit obli

g

ation

$ 41,780

$ 35,518

Change in benefit obligation:

Benefit obligation at beginning

of

y

ear

35,518

25,713

Service cost

9,255

9,096

Interest cost

2,880 2,029

Amortization of transition

obli

g

ation

3,558

1,848

Amortization of prior service

cost

1,371

2,445

Actuarial

g

ain

(7,830)

(1,838)

Benefit

p

aid

(2,972)

(3,775)

Benefit obligation at end of

y

ear

$41,780

$35,518

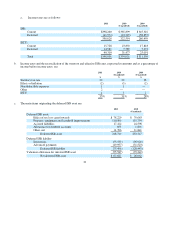

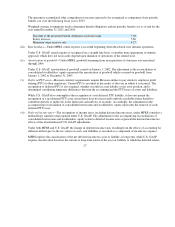

Employee retirement

obligations

2011

Employee retirement

obligations

2010

(Unaudited)

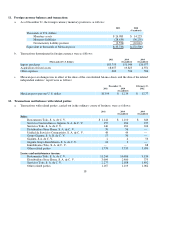

Components of net periodic cost:

Service cost

$9,255 $9,096

Interest cost

2,880

2,029

Amortization of transition obli

g

ation

3,590

1,976

Amortization of

p

rior service cost

1,371

—

Curtailment

(2,395)

—

Amortization of net

g

ain

(4,466)

(2,312)

Net

p

eriodic cost

$ 10,235

$ 10,789