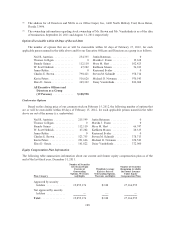

Office Depot 2011 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

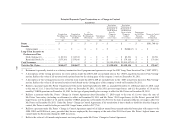

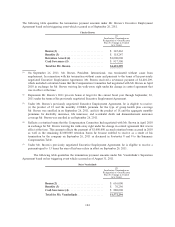

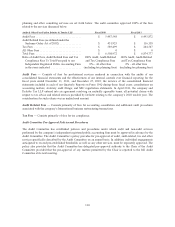

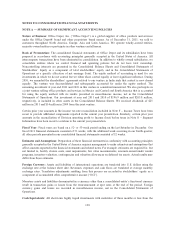

planning and other consulting services are set forth below. The audit committee approved 100% of the fees

related to the services discussed below.

Audit & Other Fees Paid to Deloitte & Touche LLP Fiscal 2010 Fiscal 2011

Audit Fees ................................ $ 5,487,548 $ 6,493,872

Audit Related Fees (as defined under the

Sarbanes-Oxley Act of 2002) ............... $ 431,925 $ 116,338

Tax Fees ................................. $ 589,499 $ 264,567

All Other Fees ............................. $ 0 $ 0

Total Fees ................................ $ 6,508,972 $ 6,874,777

Ratio of Audit Fees, Audit Related Fees and Tax

Compliance Fees To Total Fees paid to our

Independent Registered Public Accounting Firm

in the years indicated .....................

100% Audit, Audit-Related

and Tax Compliance Fees

0% – all other fees

(including tax planning fees)

100% Audit, Audit-Related

and Tax Compliance Fees

0% – all other fees

(including tax planning fees)

Audit Fees — Consists of fees for professional services rendered in connection with the audits of our

consolidated financial statements and the effectiveness of our internal controls over financial reporting for the

fiscal years ended December 31, 2011, and December 25, 2010; the reviews of the consolidated financial

statements included in each of our Quarterly Reports on Form 10-Q during those fiscal years; consultations on

accounting matters; statutory audit filings; and SEC registration statements. In April 2011, the company and

Deloitte Tax LLP entered into an agreement resolving on mutually agreeable terms, all potential claims with

respect to tax advice and related services provided by Deloitte relating to the company’s 2010 taxable year. The

consideration for such release was an undisclosed amount.

Audit Related Fees — Consists primarily of fees for accounting consultation and additional audit procedures

associated with the company’s International business restructuring transactions.

Tax Fees — Consists primarily of fees for tax compliance.

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee has established policies and procedures under which audit and non-audit services

performed by the company’s independent registered public accounting firm must be approved in advance by the

Audit Committee. The Audit Committee’s policy provides for pre-approval of audit, audit-related, tax and other

services specifically described by the Audit Committee on an annual basis. In addition, individual engagements

anticipated to exceed pre-established thresholds, as well as any other services, must be separately approved. The

policy also provides that the Audit Committee has delegated pre-approval authority to the Chair of the Audit

Committee provided that the pre-approval of any matters permitted by the Chair is reported to the full Audit

Committee at its next meeting.

110