Office Depot 2011 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

|

|

such time as the hedged item impacts earnings. At the end of the 2011, the company had entered into a series of

monthly option contracts for approximately 10 million gallons of fuel through December 2012 that may or may

not be executed.

Interest rate changes on our obligations may result from external market factors, as well as changes in our credit

rating or availability on our asset based credit facility. We manage our exposure to interest rate risks at the

corporate level. Interest rate sensitive assets and liabilities are monitored and assessed for market risk. Currently,

no interest rate related derivative arrangements are in place.

In certain markets, we may contract with third parties for our future electricity needs. Such arrangements are not

considered derivatives because they are within the ordinary course of business and are for physical delivery.

Accordingly, these arrangements are not included in the tables below.

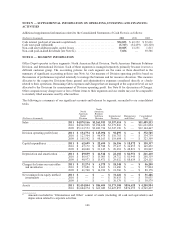

Financial instruments authorized under the company’s established risk management policy include spot trades,

swaps, options, caps, collars, forwards and futures. Use of derivative financial instruments for speculative

purposes is expressly prohibited.

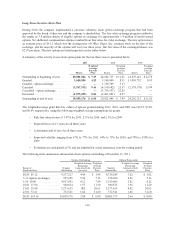

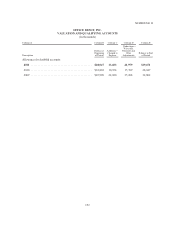

The following tables provide information on our hedging and derivative positions and activity.

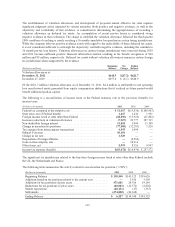

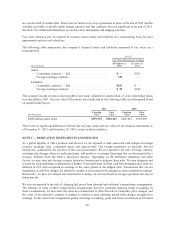

Fair value of derivative instruments

(Dollars in thousands) Balance sheet location

December 31,

2011

December 25,

2010

Derivatives designated as hedging instruments:

Foreign exchange contracts ................ Other current assets $ 284 $—

Foreign exchange contracts ................ Other current liabilities —317

Derivatives not designated as hedging instruments:

Foreign exchange contracts ................ Other current assets $57 $—

Commodity contracts — fuel .............. Other current assets —253

Other current liabilities 251

Foreign exchange contracts ................ Other current liabilities 92 117

Total derivative assets ........................ $ 341 $ 253

Total derivative liabilities ..................... $ 343 $ 434

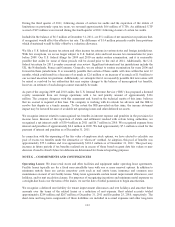

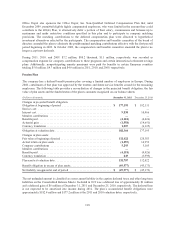

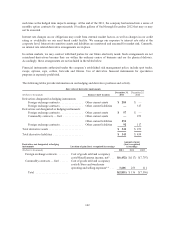

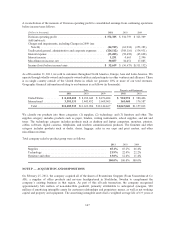

Derivatives not designated as hedging

instruments Location of gain/(loss) recognized in earnings

Amount of gain/

(loss) recognized

in earnings

(Dollars in thousands) 2011 2010 2009

Foreign exchange contracts ........ Cost of goods sold and occupancy

costs/Miscellaneous income, net* . . . $(6,452) $(117) $(7,707)

Commodity contracts — fuel ...... Cost of goods sold and occupancy

costs & Store and warehouse

operating and selling expenses** . . . 3,601 253 111

Total ....................... $(2,851) $ 136 $(7,596)

142