Office Depot 2011 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

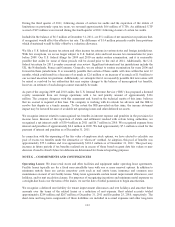

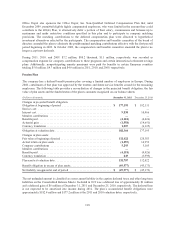

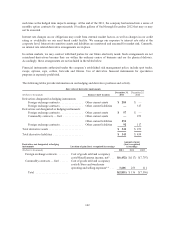

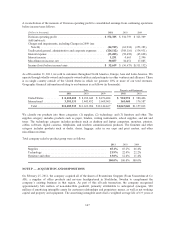

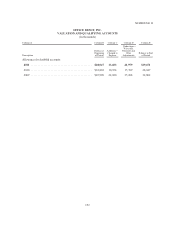

Derivatives designated as

cash flow hedges:

Amount of

gain/(loss)

recognized

in OCI

Location of gain/(loss) reclassified

from OCI into earnings

Amount of gain/

(loss) reclassified

from OCI

into earnings

(Dollars in thousands) 2011 2010 2009 2011 2010 2009

Foreign exchange

contracts .............. $1,646 $(1,982) $ (266)

Cost of goods sold and

occupancy costs* .... $1,123 $(2,229)$ —

Commodity contracts —

fuel ..................

—— 2,919

Cost of goods sold and

occupancy costs &

Store and warehouse

operating and selling

expenses** ......... —— (6,800)

Total ............... $1,646 $(1,982) $2,653 $1,123 $(2,229)$(6,800)

* For 2011, approximately 60% of the amounts are reflected in cost of goods sold and occupancy costs and

the remaining 40% of the amounts are reflected in miscellaneous income, net. For 2010 and 2009, all

amounts are reflected in cost of goods sold and occupancy costs.

** Approximately 60% of the amounts for 2011, 2010, and 2009 are reflected in cost of goods sold and

occupancy costs. The remaining 40% of the amounts are reflected in store and warehouse operating and

selling expenses.

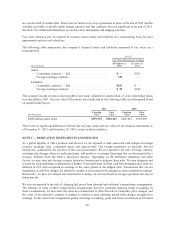

As of December 31, 2011, there were no hedging arrangements requiring collateral. However, we may be

required to provide collateral on certain arrangements in the future. The fair values of our foreign currency

contracts and fuel contracts are the amounts receivable or payable to terminate the agreements at the reporting

date, taking into account current exchange rates. The values are based on market-based inputs or unobservable

inputs that are corroborated by market data.

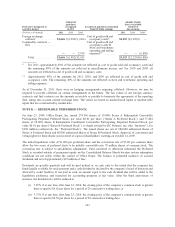

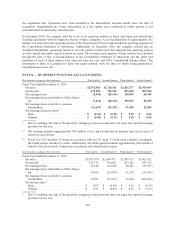

NOTE K — REDEEMABLE PREFERRED STOCK

On June 23, 2009, Office Depot, Inc. issued 274,596 shares of 10.00% Series A Redeemable Convertible

Participating Perpetual Preferred Stock, par value $0.01 per share (“Series A Preferred Stock”), and 75,404

shares of 10.00% Series B Redeemable Conditional Convertible Participating Perpetual Preferred Stock, par

value $0.01 per share (“Series B Preferred Stock”), to funds advised by BC Partners, Inc. (the “Investors”), for

$350 million (collectively, the “Preferred Stock”). The issued shares are out of 280,000 authorized shares of

Series A Preferred Stock and 80,000 authorized shares of Series B Preferred Stock. Approval of conversion and

voting rights for these shares was received at a special shareholders’ meeting on October 14, 2009.

The initial liquidation value of $1,000 per preferred share and the conversion rate of $5.00 per common share

allow the two series of preferred stock to be initially convertible into 70 million shares of common stock. The

conversion rate is subject to anti-dilution adjustments. Until converted or otherwise redeemed, the Preferred

Stock is recorded outside of permanent equity on the Consolidated Balance Sheets because certain redemption

conditions are not solely within the control of Office Depot. The balance is presented inclusive of accrued

dividends and net of approximately $25 million of fees.

Dividends are payable quarterly and will be paid in-kind or, in cash, only to the extent that the company has

funds legally available for such payment and a cash dividend is declared by the company’s board of directors and

allowed by credit facilities. If not paid in cash, an amount equal to the cash dividend due will be added to the

liquidation preference and measured for accounting purposes at fair value. After the third anniversary of

issuance, the dividend rate will be reduced to:

(i) 7.87% if at any time after June 23, 2010, the closing price of the company’s common stock is greater

than or equal to $6.62 per share for a period of 20 consecutive trading days, or

(ii) 5.75% if at any time after June 23, 2010, the closing price of the company’s common stock is greater

than or equal to $8.50 per share for a period of 20 consecutive trading days.

143