Office Depot 2011 Annual Report Download - page 60

Download and view the complete annual report

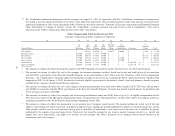

Please find page 60 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In connection with the 2011 Say on Pay vote, the company and the Compensation Committee Chair engaged in

thorough discussions of the executive compensation program with certain of the company’s largest shareholders.

A number of these shareholders informed us that the dialogue had enabled them to increase their understanding

of the company’s compensation program. Several of these shareholders focused on matters related to:

• The desire that long-term compensation be linked to long-term performance of the company;

• The combined role of Chair and CEO; and

• The membership on the Compensation Committee of Raymond Svider, a representative of BC Partners.

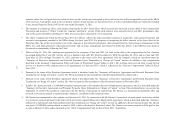

The Compensation Committee has reviewed the investor feedback received in connection with the 2011 Annual

Meeting and has deliberated extensively concerning the results of the 2011 Say on Pay vote on fiscal 2010

executive compensation. No specific component of the program was altered for 2011 based on shareholder

feedback, since it was received after the Compensation Committee had established the fiscal 2011 annual

compensation program. However, as a result of the investor feedback, as well as the discussions with Hay Group,

our compensation consultant, and management, the Compensation Committee approved a newly designed long-

term incentive program for fiscal year 2012 to continue to align the interests of executive management with

shareholders while providing stretch goals and retention value for the NEOs (other than the Chair and CEO):

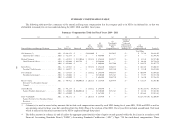

• The 2012 Long-Term Incentive Program provides an award based on a targeted value broken down as follows:

• 25% of the value of the grant in restricted stock, vesting one-third each year for 3 years;

• 25% of the value of the grant in performance-based restricted stock units, with a one year performance

period, and time-based vesting one-third each year for 3 years; and

• 50% of the value of the grant in performance-based cash, with a one year performance period, and time-

based vesting one-third each year over 3 years.

• The performance cash and performance stock units are based on whether the company achieves an EBIT target

set by the Board under the 2012 annual operating plan, with the EBIT metric designed to allow a leveraging up

if 2012 results exceed the EBIT target, subject to a maximum EBIT, or a leveraging down if 2012 results are

below target, but at or above a threshold EBIT. If actual EBIT for 2012 is less than threshold, then the

performance cash and performance stock units are forfeited and only the time-vested restricted stock (25% of

opportunity) will remain outstanding.

The Compensation Committee is evaluating changes to the CEO’s compensation in light of Say on Pay.

The company chose not to make changes regarding certain matters raised by shareholders, including:

• Regarding the combined role of Chair and CEO, the company believes this is an effective leadership structure

for the company at this time.

• Regarding the membership on the Compensation Committee of Raymond Svider, a representative of BC

Partners, the company believes that the participation of a 20% owner of the company on the Compensation

Committee is a good practice since such a director is highly motivated to rigorously oversee compensation and

is well-positioned to exercise independent judgment regarding compensation. In fact, the interests of

representatives of major shareholders are generally aligned with those of other shareholders with respect to the

oversight of executive compensation.

58