Entergy 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

95

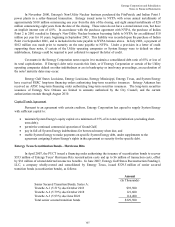

As a result of the accounting for uncertain tax positions, the amount of the deferred tax assets reflected in the

financial statements is less than the amount of the tax effect of the federal and state net operating loss carryovers, tax

credit carryovers, and other tax attributes reflected on income tax returns. The deferred tax assets recorded on the

operating and capital loss carryovers are approximately $149.6 million and $45.8 million, respectively.

Because it is more likely than not that the benefit from certain state net operating loss carryovers will not be

utilized, a valuation allowance of $47 million on the deferred tax assets relating to these state net operating loss

carryovers has been provided.

Unrecognized tax benefits

Accounting standards establish a "more-likely-than-not" recognition threshold that must be met before a tax

benefit can be recognized in the financial statements. If a tax deduction is taken on a tax return, but does not meet

the more-likely-than-not recognition threshold, an increase in income tax liability, above what is payable on the tax

return, is required to be recorded. A reconciliation of Entergy's beginning and ending amount of unrecognized tax

benefits is as follows:

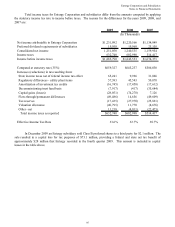

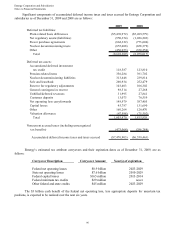

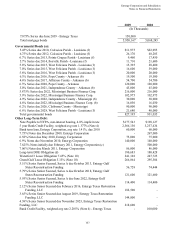

2009 2008 2007

(In Thousands)

Gross balance at January 1 $1,825,447 $2,523,794 $2,265,257

Additions based on tax positions related to the current

year 2,286,759 378,189 142,827

Additions for tax positions of prior years 697,615 259,434 670,385

Reductions for tax positions of prior years (372,862) (166,651) (450,252)

Settlements (385,321) (1,169,319) (102,485)

Lapse of statute of limitations (1,147) - (1,938)

Gross balance at December 31 4,050,491 1,825,447 2,523,794

Offsets to gross unrecognized tax benefits:

Credit and loss carryovers (3,349,589) (1,265,734) (654,888)

Cash paid to taxing authorities (373,000) (548,000) (402,000)

Unrecognized tax benefits net of unused tax attributes

and payments (1) $327,902 $11,713 $1,466,906

(1) Potential tax liability above what is payable on tax returns

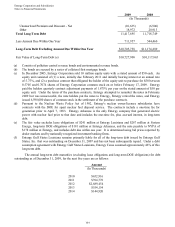

The balances of unrecognized tax benefits include $522 million, $543 million, and $242 million as of

December 31, 2009, 2008, and 2007, respectively, which, if recognized, would lower the effective income tax rates.

Because of the effect of deferred tax accounting, the remaining balances of unrecognized tax benefits of $3.53 billion,

$1.28 billion, and $1.88 billion as of December 31, 2009, 2008 and 2007 respectively, if disallowed, would not affect

the annual effective income tax rate but would accelerate the payment of cash to the taxing authority to an earlier

period. Entergy accrues interest and penalties expenses related to unrecognized tax benefits in income tax expense.

Entergy's December 31, 2009, 2008, and 2007 balance of unrecognized tax benefits includes approximately $48

million, $55 million, and $50 million, respectively, accrued for the possible payment of interest and penalties.

Entergy has deposits of $373 million on account with the IRS to cover its uncertain tax positions.

Entergy does not expect that total unrecognized tax benefits will significantly change within the next twelve

months; however, the results of pending litigations and audit issues, discussed below, could result in significant

changes.

97