Entergy 2009 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Management's Financial Discussion and Analysis

45

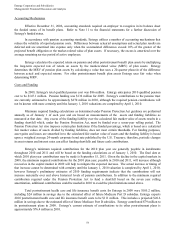

Commodity Price Risk

Power Generation

As a wholesale generator, Entergy's Non-Utility Nuclear business's core business is selling energy, measured

in MWh, to its customers. Non-Utility Nuclear enters into forward contracts with its customers and sells energy in

the day ahead or spot markets. In addition to selling the energy produced by its plants, Non-Utility Nuclear sells

unforced capacity to load-serving entities, which allows those companies to meet specified reserve and related

requirements placed on them by the ISOs in their respective areas. Non-Utility Nuclear's forward fixed price power

contracts consist of contracts to sell energy only, contracts to sell capacity only, and bundled contracts in which it

sells both capacity and energy. While the terminology and payment mechanics vary in these contracts, each of these

types of contracts requires Non-Utility Nuclear to deliver MWh of energy to its counterparties, make capacity

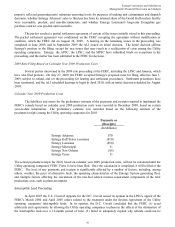

available to them, or both. The following is a summary as of December 31, 2009 of the amount of Non-Utility

Nuclear's nuclear power plants' planned energy output that is sold forward under physical or financial contracts:

2010 2011 2012 2013 2014

Non-Utility Nuclear:

Percent of planned generation sold forward:

Unit-contingent 53% 54% 18% 12% 14%

Unit-contingent with guarantee of availability (1) 35% 17% 13% 6% 3%

Firm liquidated damages 0% 3% 0% 0% 0%

Total 88% 74% 31% 18% 17%

Planned generation (TWh) 40 41 41 40 41

Average contracted price per MWh (2) $57 $56 $56 $50 $50

The following is a summary as of December 31, 2008 of the amount of Non-Utility Nuclear's nuclear power

plants' planned energy output that is sold forward under physical or financial contracts:

2009 2010 2011 2012 2013

Non-Utility Nuclear:

Percent of planned generation sold forward:

Unit-contingent 48% 31% 29% 18% 12%

Unit-contingent with guarantee of availability (1) 38% 35% 17% 7% 6%

Total 86% 66% 46% 25% 18%

Planned generation (TWh) 41 40 41 41 40

Average contracted price per MWh (2) $61 $60 $56 $54 $50

(1) A sale of power on a unit-contingent basis coupled with a guarantee of availability provides for the

payment to the power purchaser of contract damages, if incurred, in the event the seller fails to deliver

power as a result of the failure of the specified generation unit to generate power at or above a specified

availability threshold. All of Entergy's outstanding guarantees of availability provide for dollar limits on

Entergy's maximum liability under such guarantees.

(2) The Vermont Yankee acquisition included a 10-year PPA under which the former owners will buy most

of the power produced by the plant, which is through the expiration in 2012 of the current operating

license for the plant. The PPA includes an adjustment clause under which the prices specified in the

PPA will be adjusted downward monthly, beginning in November 2005, if power market prices drop

below PPA prices, which has not happened thus far.

47