Entergy 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

102

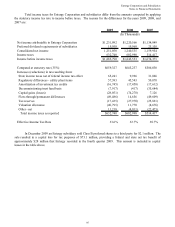

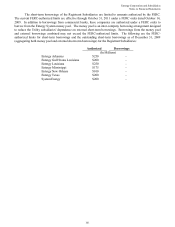

2009 2008

(In Thousands)

Unamortized Premium and Discount - Net (10,635) (6,906)

Other 18,972 28,913

Total Long-Term Debt 11,417,695 11,718,749

Less Amount Due Within One Year 711,957 544,460

Long-Term Debt Excluding Amount Due Within One Year $10,705,738 $11,174,289

Fair Value of Long-Term Debt (e) $10,727,908 $10,117,865

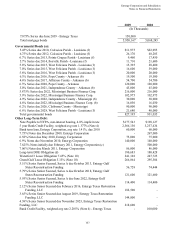

(a) Consists of pollution control revenue bonds and environmental revenue bonds.

(b) The bonds are secured by a series of collateral first mortgage bonds.

(c) In December 2005, Entergy Corporation sold 10 million equity units with a stated amount of $50 each. An

equity unit consisted of (1) a note, initially due February 2011 and initially bearing interest at an annual rate

of 5.75%, and (2) a purchase contract that obligated the holder of the equity unit to purchase for $50 between

0.5705 and 0.7074 shares of Entergy Corporation common stock on or before February 17, 2009. Entergy

paid the holders quarterly contract adjustment payments of 1.875% per year on the stated amount of $50 per

equity unit. Under the terms of the purchase contracts, Entergy attempted to remarket the notes in February

2009 but was unsuccessful, the note holders put the notes to Entergy, Entergy retired the notes, and Entergy

issued 6,598,000 shares of common stock in the settlement of the purchase contracts.

(d) Pursuant to the Nuclear Waste Policy Act of 1982, Entergy's nuclear owner/licensee subsidiaries have

contracts with the DOE for spent nuclear fuel disposal service. The contracts include a one-time fee for

generation prior to April 7, 1983. Entergy Arkansas is the only Entergy company that generated electric

power with nuclear fuel prior to that date and includes the one-time fee, plus accrued interest, in long-term

debt.

(e) The fair value excludes lease obligations of $241 million at Entergy Louisiana and $267 million at System

Energy, long-term DOE obligations of $181 million at Entergy Arkansas, and the note payable to NYPA of

$178 million at Entergy, and includes debt due within one year. It is determined using bid prices reported by

dealer markets and by nationally recognized investment banking firms.

(f) Entergy Gulf States Louisiana remains primarily liable for all of the long-term debt issued by Entergy Gulf

States, Inc. that was outstanding on December 31, 2007 and has not been subsequently repaid. Under a debt

assumption agreement with Entergy Gulf States Louisiana, Entergy Texas assumed approximately 46% of this

long-term debt.

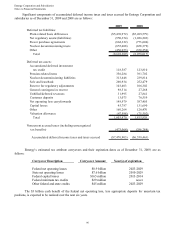

The annual long-term debt maturities (excluding lease obligations and long-term DOE obligations) for debt

outstanding as of December 31, 2009, for the next five years are as follows:

Amount

(In Thousands)

2010 $652,916

2011 $394,778

2012 $2,689,454

2013 $554,154

2014 $144,920

104