Entergy 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154

|

|

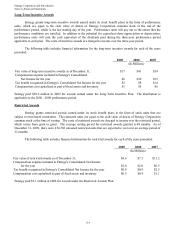

Entergy Corporation and Subsidiaries

Notes to Financial Statements

122

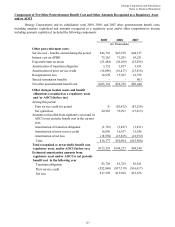

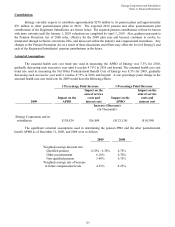

Other Postretirement Benefit Obligations, Plan Assets, Funded Status, and Amounts Not Yet Recognized and

Recognized in the Balance Sheet of Entergy Corporation and its Subsidiaries as of December 31, 2009 and

2008

December 31,

2009 2008

(In Thousands)

Change in APBO

Balance at beginning of year $1,155,072 $1,129,631

Service cost 46,765 47,198

Interest cost 75,265 71,295

Plan amendments -(5,422)

Plan participant contributions 17,394 8,618

Actuarial (gain)/loss 59,537 (33,168)

Benefits paid (79,076) (68,799)

Medicare Part D subsidy received 5,119 5,719

Balance at end of year $1,280,076 $1,155,072

Change in Plan Assets

Fair value of assets at beginning of year $295,908 $350,719

Actual return on plan assets 58,038 (64,350)

Employer contributions 70,135 69,720

Plan participant contributions 17,394 8,618

Acquisition - -

Benefits paid (79,076) (68,799)

Fair value of assets at end of year $362,399 $295,908

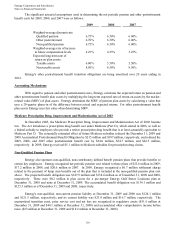

Funded status ($917,677) ($859,164)

Amounts recognized in the balance sheet

Current liabilities ($31,189) ($29,594)

Non-current liabilities (886,488) (829,570)

Total funded status ($917,677) ($859,164)

Amounts recognized as a regulatory asset (before tax)

Transition obligation $9,325 $12,436

Prior service cost/(credit) 1,877 (966)

Net loss 239,400 266,086

$250,602 $277,556

Amounts recognized as AOCI (before tax)

Transition obligation $1,862 $2,483

Prior service credit (21,855) (35,108)

Net loss 147,563 114,864

$127,570 $82,239

124