Entergy 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

97

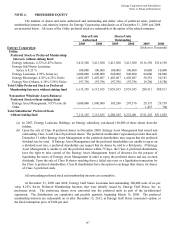

Qualified research expenditures for purposes of the research credit

Inclusion of nuclear decommissioning liabilities in cost of goods sold

It is anticipated that IRS Appeals proceedings on these disputed issues will commence in the second quarter of 2010.

2006-2007 IRS Audit

The IRS commenced an examination of Entergy's 2006 and 2007 U.S. federal income tax returns in the third

quarter 2009. To date, the IRS has not proposed any adjustments in the audit of these returns.

Other Tax Matters

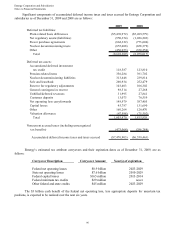

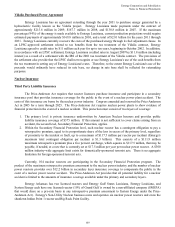

When Entergy Louisiana, Inc. restructured effective December 31, 2005, Entergy Louisiana agreed, under

the terms of the merger plan, to indemnify its parent, Entergy Louisiana Holdings, Inc. (formerly, Entergy Louisiana,

Inc.) for certain tax obligations that arose from the 2002-2003 IRS partial agreement. Because the agreement with

the IRS was settled in the fourth quarter 2009, Entergy Louisiana paid Entergy Louisiana Holdings approximately

$289 million pursuant to these intercompany obligations in the fourth quarter 2009.

On November 20, 2009, Entergy Corporation and subsidiaries amended the Entergy Corporation and

Subsidiary Companies Intercompany Income Tax Allocation Agreement such that Entergy Corporation shall be

treated, under all provisions of such Agreement, in a manner that is identical to the treatment afforded all

subsidiaries, direct or indirect, of Entergy Corporation.

In the fourth quarter 2009, Entergy filed Applications for Change in Method of Accounting for certain costs

under Section 263A of the Internal Revenue Code. In the Application, Entergy is requesting permission to treat the

nuclear decommissioning liability associated with the operation of its nuclear power plants as a production cost

properly includable in cost of goods sold. The effect of this change for Entergy is a $5.7 billion reduction in 2009

taxable income within Non-Utility Nuclear.

NOTE 4. REVOLVING CREDIT FACILITIES, LINES OF CREDIT AND SHORT-TERM

BORROWINGS

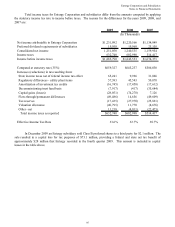

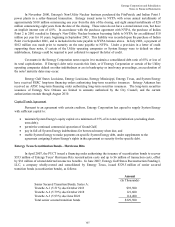

Entergy Corporation has a revolving credit facility that expires in August 2012 and has a borrowing capacity

of $3.5 billion. Entergy Corporation also has the ability to issue letters of credit against the total borrowing capacity

of the credit facility. The facility fee is currently 0.09% of the commitment amount. Facility fees and interest rates

on loans under the credit facility can fluctuate depending on the senior unsecured debt ratings of Entergy

Corporation. The weighted average interest rate for the year ended December 31, 2009 was 1.377% on the drawn

portion of the facility. Following is a summary of the borrowings outstanding and capacity available under the

facility as of December 31, 2009.

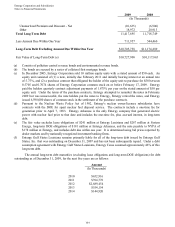

Capacity Borrowings

Letters

of Credit

Capacity

Available

(In Millions)

$3,500 $2,566 $28 $906

Entergy Corporation's facility requires it to maintain a consolidated debt ratio of 65% or less of its total

capitalization. Entergy is in compliance with this covenant. If Entergy fails to meet this ratio, or if Entergy

Corporation or one of the Utility operating companies (except Entergy New Orleans) defaults on other indebtedness

or is in bankruptcy or insolvency proceedings, an acceleration of the facility maturity date may occur.

99