Entergy 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Management's Financial Discussion and Analysis

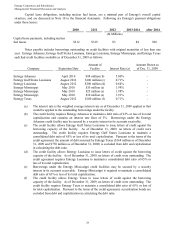

28

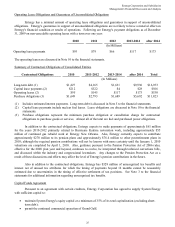

authorization from the FERC, and Entergy Arkansas has obtained long-term financing authorization from the APSC.

The long-term securities issuances of Entergy New Orleans are limited to amounts authorized by the City Council,

and the current authorization extends through August 2010. In addition to borrowings from commercial banks, the

FERC short-term borrowing orders authorized the Registrant Subsidiaries to continue as participants in the Entergy

System money pool. The money pool is an intercompany borrowing arrangement designed to reduce Entergy's

subsidiaries' dependence on external short-term borrowings. Borrowings from the money pool and external short-

term borrowings combined may not exceed authorized limits. As of December 31, 2009, Entergy's subsidiaries had

no outstanding short-term borrowings from external sources. See Notes 4 and 5 to the financial statements for

further discussion of Entergy's borrowing limits and authorizations.

Hurricane Gustav and Hurricane Ike

In September 2008, Hurricane Gustav and Hurricane Ike caused catastrophic damage to portions of

Entergy's service territories in Louisiana and Texas, and to a lesser extent in Arkansas and Mississippi. The storms

resulted in widespread power outages, significant damage to distribution, transmission, and generation infrastructure,

and the loss of sales during the power outages. In October 2008, Entergy Gulf States Louisiana, Entergy Louisiana,

and Entergy New Orleans drew a total of $229 million from their funded storm reserves.

Entergy Gulf States Louisiana and Entergy Louisiana filed their Hurricane Gustav and Hurricane Ike storm

cost recovery case with the LPSC in May 2009. In September 2009, Entergy Gulf States Louisiana and Entergy

Louisiana made a supplemental filing to, among other things, recommend recovery of the costs and replenishment of

the storm reserves by Louisiana Act 55 (passed in 2007) financing. Entergy Gulf States Louisiana and Entergy

Louisiana recovered their costs from Hurricane Katrina and Hurricane Rita primarily by Act 55 financing, as

discussed below. On December 30, 2009, Entergy Gulf States Louisiana and Entergy Louisiana entered into a

stipulation agreement with the LPSC Staff that, if approved, provides for total recoverable costs of approximately

$234 million for Entergy Gulf States Louisiana and $394 million for Entergy Louisiana. Under this stipulation,

Entergy Gulf States Louisiana agrees not to recover $4.4 million and Entergy Louisiana agrees not to recover $7.2

million of their storm restoration spending. The stipulation also permits replenishing Entergy Gulf States Louisiana's

storm reserve in the amount of $90 million and Entergy Louisiana's storm reserve in the amount of $200 million

when Act 55 financing is accomplished. The parties to the proceeding have agreed to a procedural schedule that

includes March/April 2010 hearing dates for both the recoverability and the method of recovery proceedings.

Entergy Texas filed an application in April 2009 seeking a determination that $577.5 million of Hurricane

Ike and Hurricane Gustav restoration costs are recoverable, including estimated costs for work to be completed. On

August 5, 2009, Entergy Texas submitted to the ALJ an unopposed settlement agreement intended to resolve all

issues in the storm cost recovery case. Under the terms of the agreement $566.4 million, plus carrying costs, are

eligible for recovery. Insurance proceeds will be credited as an offset to the securitized amount. Of the $11.1 million

difference between Entergy Texas' request and the amount agreed to, which is part of the black box agreement and

not directly attributable to any specific individual issues raised, $6.8 million is operation and maintenance expense

for which Entergy Texas recorded a charge in the second quarter 2009. The remaining $4.3 million was recorded as

utility plant. The PUCT approved the settlement in August 2009, and in September 2009 the PUCT approved

recovery of the costs, plus carrying costs, by securitization. In November 2009, Entergy Texas Restoration Funding,

LLC (Entergy Texas Restoration Funding), a company wholly-owned and consolidated by Entergy Texas, issued

$545.9 million of senior secured transition bonds (securitization bonds). See Note 5 to the financial statements for a

discussion of the November 2009 issuance of the securitization bonds.

In the third quarter 2009, Entergy settled with its insurer on its Hurricane Ike claim and Entergy Texas

received $75.5 million in proceeds (Entergy received a total of $76.5 million).

30