Entergy 2009 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

141

Due to regulatory treatment, the natural gas swaps are marked to market through fuel, fuel-related expenses, and gas

purchased for resale and then such amounts are simultaneously reversed and recorded as offsetting regulatory assets

or liabilities. The gains or losses recorded as fuel expenses when the swaps are settled are recovered through each

Registrant's fuel recovery mechanism.

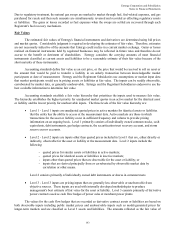

Fair Values

The estimated fair values of Entergy's financial instruments and derivatives are determined using bid prices

and market quotes. Considerable judgment is required in developing the estimates of fair value. Therefore, estimates

are not necessarily indicative of the amounts that Entergy could realize in a current market exchange. Gains or losses

realized on financial instruments held by regulated businesses may be reflected in future rates and therefore do not

accrue to the benefit or detriment of shareholders. Entergy considers the carrying amounts of most financial

instruments classified as current assets and liabilities to be a reasonable estimate of their fair value because of the

short maturity of these instruments.

Accounting standards define fair value as an exit price, or the price that would be received to sell an asset or

the amount that would be paid to transfer a liability in an orderly transaction between knowledgeable market

participants at date of measurement. Entergy and the Registrant Subsidiaries use assumptions or market input data

that market participants would use in pricing assets or liabilities at fair value. The inputs can be readily observable,

corroborated by market data, or generally unobservable. Entergy and the Registrant Subsidiaries endeavor to use the

best available information to determine fair value.

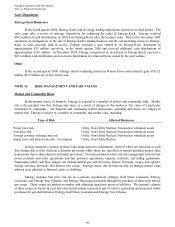

Accounting standards establish a fair value hierarchy that prioritizes the inputs used to measure fair value.

The hierarchy establishes the highest priority for unadjusted market quotes in an active market for the identical asset

or liability and the lowest priority for unobservable inputs. The three levels of the fair value hierarchy are:

Level 1 - Level 1 inputs are unadjusted quoted prices in active markets for identical assets or liabilities

that the entity has the ability to access at the measurement date. Active markets are those in which

transactions for the asset or liability occur in sufficient frequency and volume to provide pricing

information on an ongoing basis. Level 1 primarily consists of individually owned common stocks, cash

equivalents, debt instruments, gas hedge contracts, the securitization trust recovery account, and storm

reserve escrow accounts.

Level 2 - Level 2 inputs are inputs other than quoted prices included in Level 1 that are, either directly or

indirectly, observable for the asset or liability at the measurement date. Level 2 inputs include the

following:

-quoted prices for similar assets or liabilities in active markets;

-quoted prices for identical assets or liabilities in inactive markets;

-inputs other than quoted prices that are observable for the asset or liability; or

- inputs that are derived principally from or corroborated by observable market data by

correlation or other means.

Level 2 consists primarily of individually owned debt instruments or shares in common trusts.

Level 3 - Level 3 inputs are pricing inputs that are generally less observable or unobservable from

objective sources. These inputs are used with internally developed methodologies to produce

management's best estimate of fair value for the asset or liability. Level 3 consists primarily of derivative

power contracts used as cash flow hedges of power sales at merchant power plants.

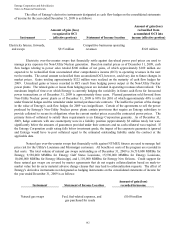

The values for the cash flow hedges that are recorded as derivative contract assets or liabilities are based on

both observable inputs including public market prices and unobservable inputs such as model-generated prices for

longer-term markets and are classified as Level 3 assets and liabilities. The amounts reflected as the fair value of

143