Entergy 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

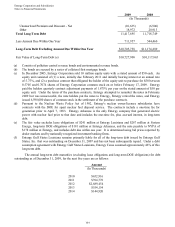

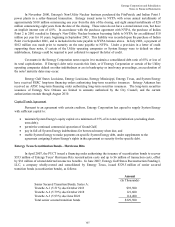

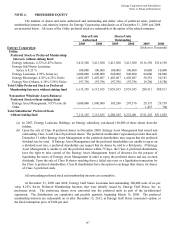

Entergy Corporation and Subsidiaries

Notes to Financial Statements

96

Income Tax Litigation

For tax years 1997 and 1998, a U.S. Tax Court trial was held in April 2008. The issues before the Court

are as follows:

The ability to credit the U.K. Windfall Tax against U.S. tax as a foreign tax credit. The U.K. Windfall Tax

relates to Entergy's former investment in London Electricity.

The validity of Entergy's change in method of tax accounting for street lighting assets and the related

increase in depreciation deductions.

On November 20, 2009, Entergy was directed by the Tax Court to submit a supplement to previously filed

supplemental briefs addressing the issues in dispute. A decision is anticipated by the first or second quarter 2010.

On February 21, 2008, the IRS issued a Statutory Notice of Deficiency for the year 2000. A Tax Court

Petition was filed on May 5, 2008. Trial is set for April 17, 2010. The Petition challenges the IRS assessment on

the same two issues described above as well as the following issue:

The allowance of depreciation deductions that resulted from Entergy's purchase price allocations on its

acquisitions of its Non-Utility Nuclear plants.

With respect to the U.K. Windfall Tax issue, the total tax included in IRS Notices of Deficiency is $82

million. The total tax and interest associated with this issue for all years is $209 million before consideration of cash

deposits made with the IRS to offset the potential exposure.

With respect to the street lighting issue, the total tax included in IRS Notices of Deficiency is $22 million.

The federal and state tax and interest associated with this issue total $61 million for all open tax years.

With respect to the depreciation deducted on Non-Utility Nuclear plant acquisitions, the total tax included in

IRS Notices of Deficiency is $7 million. The federal and state tax and interest associated with this issue total $270

million for all open tax years.

Income Tax Audits

Entergy or one of its subsidiaries files U.S. federal and various state and foreign income tax returns. Other

than the matters discussed in the Income Tax Litigation section above, the IRS's and substantially all state taxing

authorities' examinations are completed for years before 2004.

2002-2003 IRS Audit

In September 2009, Entergy entered into a partial agreement with the IRS for the years 2002 and 2003. It is

a partial agreement because Entergy did not agree to the IRS's adjustments for the U.K. Windfall Tax foreign tax

credit and the street lighting issues. Entergy expects to receive a Notice of Deficiency from the IRS on these two

issues in the first quarter 2010. These issues will be governed by the outcome of a previous U.S. Tax Court trial for

the tax years 1997 and 1998 for which Entergy is awaiting a decision.

2004-2005 IRS Audit

The IRS issued its 2004-2005 Revenue Agent's Report on May 26, 2009.

On June 25, 2009 Entergy filed a formal Protest with the IRS Appeals Office indicating disagreement with

certain issues contained in the Revenue Agent’ s Report. The major issues in dispute are:

Depreciation of street lighting assets (issue before the Tax Court)

Depreciable basis of assets acquired in Non-Utility Nuclear plant purchases (issue before the Tax Court)

98