Entergy 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

68

Nuclear Refueling Outage Costs

Nuclear refueling outage costs are deferred during the outage and amortized over the estimated period to the

next outage because these refueling outage expenses are incurred to prepare the units to operate for the next operating

cycle without having to be taken off line.

Allowance for Funds Used During Construction (AFUDC)

AFUDC represents the approximate net composite interest cost of borrowed funds and a reasonable return

on the equity funds used for construction by the Registrant Subsidiaries. AFUDC increases both the plant balance

and earnings and is realized in cash through depreciation provisions included in rates.

Income Taxes

Entergy Corporation and the majority of its subsidiaries file a United States consolidated federal income tax

return. Each tax paying entity records income taxes as if it were a separate taxpayer and consolidating adjustments

are allocated to the tax filing entities in accordance with Entergy's intercompany income tax allocation agreement.

Deferred income taxes are recorded for all temporary differences between the book and tax basis of assets and

liabilities, and for certain credits available for carryforward. Entergy Louisiana, formed December 31, 2005, was

not a member of the consolidated group in 2006 and 2007 and filed a separate federal income tax return. Beginning

January 1, 2008, Entergy Louisiana joined the Entergy consolidated federal income tax return.

Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more

likely than not that some portion of the deferred tax assets will not be realized. Deferred tax assets and liabilities are

adjusted for the effects of changes in tax laws and rates in the period in which the tax or rate was enacted.

Investment tax credits are deferred and amortized based upon the average useful life of the related property,

in accordance with ratemaking treatment.

Earnings per Share

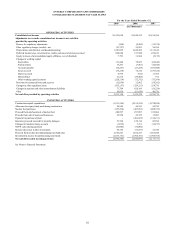

The following table presents Entergy's basic and diluted earnings per share calculation included on the

consolidated statements of income:

For the Years Ended December 31,

2009 2008 2007

(In Millions, Except Per Share Data)

Basic earnings per average

common share

Income Shares $/share Income Shares $/share Income Shares $/share

Net income attributable to

Entergy Corporation $1,231.1 192.8 $6.39 $1,220.6 190.9 $6.39 $1,134.8 196.6 $5.77

Average dilutive effect of:

Stock options - 2.2 (0.07) - 4.1 (0.13) - 5.0 (0.14)

Equity units 3.2 0.8 (0.02) 24.7 6.0 (0.06) - 1.1 (0.03)

Deferred units - - - - - - - 0.1 -

Diluted earnings per average

common share $1,234.3 195.8 $6.30 $1,245.3 201.0 $6.20 $1,134.8 202.8 $5.60

The calculation of diluted earnings per share excluded 4,368,614 options outstanding at December 31, 2009

that could potentially dilute basic earnings per share in the future. Those options were not included in the calculation

70