Entergy 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Management's Financial Discussion and Analysis

52

Accounting Mechanisms

Effective December 31, 2006, accounting standards required an employer to recognize in its balance sheet

the funded status of its benefit plans. Refer to Note 11 to the financial statements for a further discussion of

Entergy's funded status.

In accordance with pension accounting standards, Entergy utilizes a number of accounting mechanisms that

reduce the volatility of reported pension costs. Differences between actuarial assumptions and actual plan results are

deferred and are amortized into expense only when the accumulated differences exceed 10% of the greater of the

projected benefit obligation or the market-related value of plan assets. If necessary, the excess is amortized over the

average remaining service period of active employees.

Entergy calculates the expected return on pension and other postretirement benefit plan assets by multiplying

the long-term expected rate of return on assets by the market-related value (MRV) of plan assets. Entergy

determines the MRV of pension plan assets by calculating a value that uses a 20-quarter phase-in of the difference

between actual and expected returns. For other postretirement benefit plan assets Entergy uses fair value when

determining MRV.

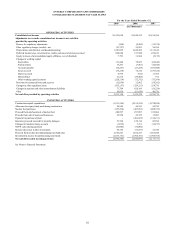

Costs and Funding

In 2009, Entergy's total qualified pension cost was $86 million. Entergy anticipates 2010 qualified pension

cost to be $147.1 million. Pension funding was $132 million for 2009. Entergy's contributions to the pension trust

are currently estimated to be approximately $270 million in 2010, although the required pension contributions will

not be known with more certainty until the January 1, 2010 valuations are completed by April 1, 2010.

Minimum required funding calculations as determined under Pension Protection Act guidance are performed

annually as of January 1 of each year and are based on measurements of the assets and funding liabilities as

measured at that date. Any excess of the funding liability over the calculated fair market value of assets results in a

funding shortfall which, under the Pension Protection Act, must be funded over a seven-year rolling period. The

Pension Protection Act also imposes certain plan limitations if the funded percentage, which is based on a calculated

fair market values of assets divided by funding liabilities, does not meet certain thresholds. For funding purposes,

asset gains and losses are smoothed in to the calculated fair market value of assets and the funding liability is based

upon a weighted average 24-month corporate bond rate published by the U.S. Treasury; therefore, periodic changes

in asset returns and interest rates can affect funding shortfalls and future cash contributions.

Entergy's minimum required contributions for the 2010 plan year are generally payable in installments

throughout 2010 and 2011 and will be based on the funding calculations as of January 1, 2010. The final date at

which 2010 plan year contributions may be made is September 15, 2011. Given the decline in the capital markets in

2008, the minimum required contributions for the 2010 plan year, payable in 2010 and 2011, will increase although

recoveries in the capital market in 2009 will help to mitigate the expected increase. The actual increase or timing of

that increase cannot be determined with certainty until the January 1, 2010 valuation is completed by April 1, 2010;

however Entergy’ s preliminary estimates of 2010 funding requirements indicate that the contributions will not

increase materially over and above historical levels of pension contributions. In addition to the minimum required

contribution required under the Pension Protection Act to fund a shortfall based on the seven year rolling

amortization, additional contributions could be needed in 2010 to avoid the plan limitations noted above.

Total postretirement health care and life insurance benefit costs for Entergy in 2009 were $105.2 million,

including $24 million in savings due to the estimated effect of future Medicare Part D subsidies. Entergy expects

2010 postretirement health care and life insurance benefit costs to be $111 million. This includes a projected $26.6

million in savings due to the estimated effect of future Medicare Part D subsidies. Entergy contributed $79 million to

its postretirement plans in 2009. Entergy’ s current estimate of contributions to its other postretirement plans is

approximately $76.4 million in 2010.

54