Entergy 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

94

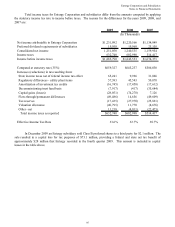

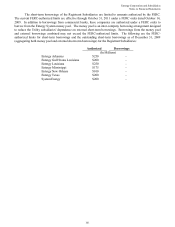

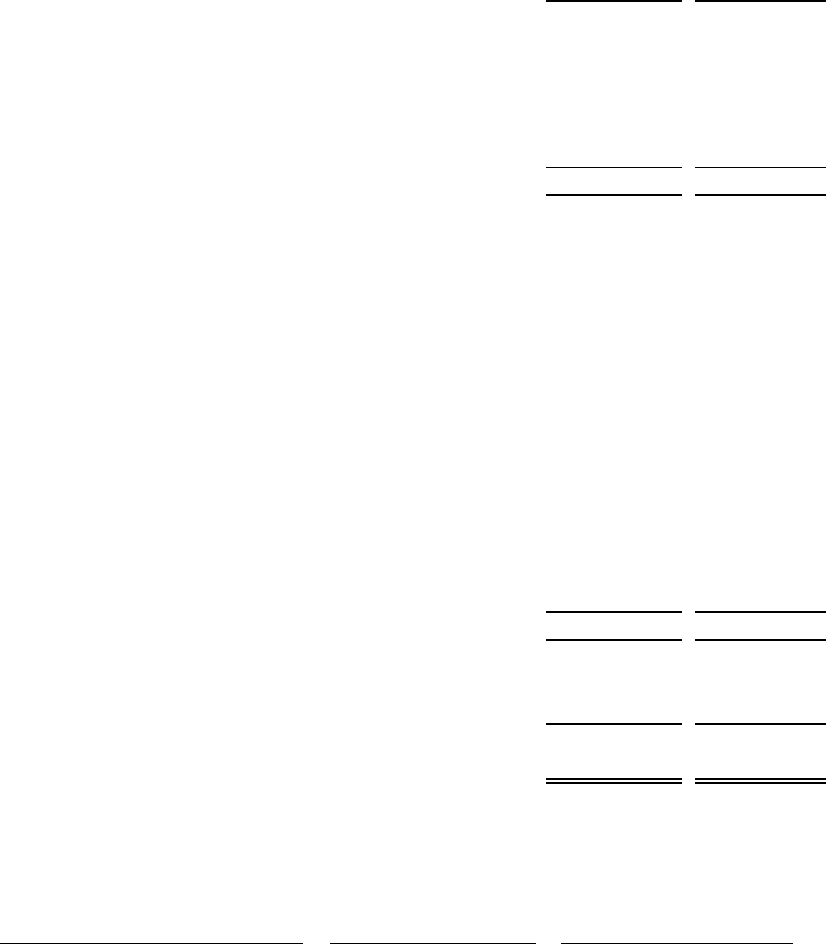

Significant components of accumulated deferred income taxes and taxes accrued for Entergy Corporation and

subsidiaries as of December 31, 2009 and 2008 are as follows:

2009 2008

Deferred tax liabilities:

Plant-related basis differences ($5,476,972) ($5,269,579)

Net regulatory assets/(liabilities) (950,354) (1,026,203)

Power purchase agreements (862,322) (773,606)

Nuclear decommissioning trusts (855,608) (658,379)

Other (456,053) (350,250)

Total (8,601,309) (8,078,017)

Deferred tax assets:

Accumulated deferred investment

tax credit 118,587 123,810

Pension-related items 356,284 391,702

Nuclear decommissioning liabilities 313,648 239,814

Sale and leaseback 260,934 252,479

Reserve for regulatory adjustments 103,403 106,302

General contingencies reserve 98,514 27,268

Unbilled/deferred revenues 31,995 27,841

Customer deposits 13,073 76,559

Net operating loss carryforwards 148,979 387,405

Capital losses 45,787 131,690

Other 160,264 126,470

Valuation allowance (47,998) (75,502)

Total 1,603,470 1,815,838

Noncurrent accrued taxes (including unrecognized

tax benefits) (473,064) (296,284)

Accumulated deferred income taxes and taxes accrued ($7,470,903) ($6,558,463)

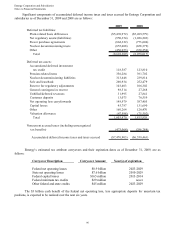

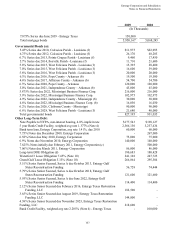

Entergy’ s estimated tax attribute carryovers and their expiration dates as of December 31, 2009, are as

follows:

Carryover Description Carryover Amount Year(s) of expiration

Federal net operating losses $8.9 billion 2023-2029

State net operating losses $7.6 billion 2010-2029

Federal capital losses $165 million 2013-2014

Federal minimum tax credits $29 million never

Other federal and state credits $45 million 2023-2029

The $3 billion cash benefit of the federal net operating loss, less appropriate deposits for uncertain tax

positions, is expected to be realized over the next six years.

96