Entergy 2009 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

142

derivative assets or liabilities are based on the estimated amount that the contracts are in-the-money at the balance

sheet date (treated as an asset) or out-of-the-money at the balance sheet date (treated as a liability) and would equal

the estimated amount receivable or payable by Entergy if the contracts were settled at that date. These derivative

contracts include cash flow hedges that swap fixed for floating cash flows for sales of the output from Entergy's Non-

Utility Nuclear business. The fair values are based on the mark-to-market comparison between the fixed contract

prices and the floating prices determined each period from a combination of quoted forward power market prices for

the period for which such curves are available, and model-generated prices using quoted forward gas market curves

and estimates regarding heat rates to convert gas to power and the costs associated with the transportation of the

power from the plants' bus bar to the contract's point of delivery, generally a power market hub, for the period

thereafter. The difference between the fixed price in the swap contract and these market-related prices multiplied by

the volume specified in the contract and discounted at the counterparties' credit adjusted risk free rate are recorded as

derivative contract assets or liabilities. $202 million of cash flow hedges as of December 31, 2009 are in-the-money

contracts with counterparties who are all currently investment grade. $2 million of the cash flow hedges as of

December 31, 2009 are out-of-the-money contracts supported by corporate guarantees, which would require

additional cash or letters of credit in the event of a decrease in Entergy Corporation’ s credit rating to below

investment grade.

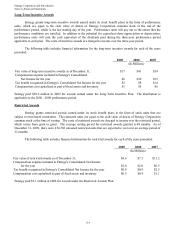

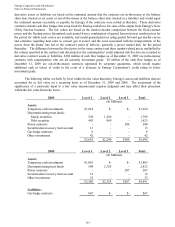

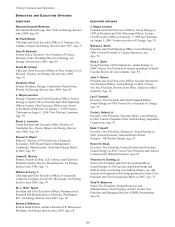

The following tables set forth, by level within the fair value hierarchy, Entergy's assets and liabilities that are

accounted for at fair value on a recurring basis as of December 31, 2009 and 2008. The assessment of the

significance of a particular input to a fair value measurement requires judgment and may affect their placement

within the fair value hierarchy levels.

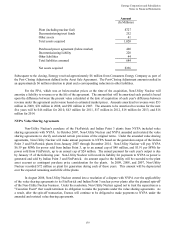

2009 Level 1 Level 2 Level 3 Total

(In Millions)

Assets:

Temporary cash investments $1,624 $- $- $1,624

Decommissioning trust funds:

Equity securities 528 1,260 - 1,788

Debt securities 443 980 - 1,423

Power contracts - - 200 200

Securitization recovery trust account 13 - - 13

Gas hedge contracts 8 - - 8

Other investments 42 - - 42

$2,658 $2,240 $200 $5,098

2008 Level 1 Level 2 Level 3 Total

(In Millions)

Assets:

Temporary cash investments $1,805 $- $- $1,805

Decommissioning trust funds 508 2,324 - 2,832

Power contracts - -207 207

Securitization recovery trust account 12 - - 12

Other investments 35 - - 35

$2,360 $2,324 $207 $4,891

Liabilities:

Gas hedge contracts $67 $- $- $67

144