Entergy 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

71

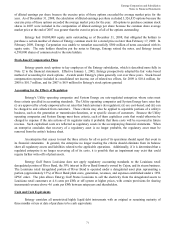

criteria and are not recognized on the balance sheet. Revenues and expenses from these contracts are reported on a

gross basis in the appropriate revenue and expense categories as the commodities are received or delivered.

For other contracts for commodities in which Entergy is hedging the variability of cash flows related to a

variable-rate asset, liability, or forecasted transactions that qualify as cash flow hedges, the changes in the fair value

of such derivative instruments are reported in other comprehensive income. To qualify for hedge accounting, the

relationship between the hedging instrument and the hedged item must be documented to include the risk management

objective and strategy and, at inception and on an ongoing basis, the effectiveness of the hedge in offsetting the

changes in the cash flows of the item being hedged. Gains or losses accumulated in other comprehensive income are

reclassified as earnings in the periods in which earnings are affected by the variability of the cash flows of the hedged

item. The ineffective portions of all hedges are recognized in current-period earnings.

Entergy has determined that contracts to purchase uranium do not meet the definition of a derivative under

the accounting standards for derivative instruments because they do not provide for net settlement and the uranium

markets are not sufficiently liquid to conclude that forward contracts are readily convertible to cash. If the uranium

markets do become sufficiently liquid in the future and Entergy begins to account for uranium purchase contracts as

derivative instruments, the fair value of these contracts would be accounted for consistent with Entergy's other

derivative instruments.

Fair Values

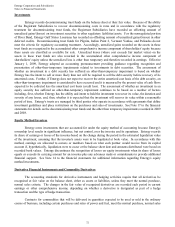

The estimated fair values of Entergy's financial instruments and derivatives are determined using bid prices

and market quotes. Considerable judgment is required in developing the estimates of fair value. Therefore, estimates

are not necessarily indicative of the amounts that Entergy could realize in a current market exchange. Gains or losses

realized on financial instruments held by regulated businesses may be reflected in future rates and therefore do not

accrue to the benefit or detriment of stockholders. Entergy considers the carrying amounts of most financial

instruments classified as current assets and liabilities to be a reasonable estimate of their fair value because of the

short maturity of these instruments. See Note 16 to the financial statements for further discussion of fair value.

Impairment of Long-Lived Assets

Entergy periodically reviews long-lived assets held in all of its business segments whenever events or changes

in circumstances indicate that recoverability of these assets is uncertain. Generally, the determination of

recoverability is based on the undiscounted net cash flows expected to result from such operations and assets.

Projected net cash flows depend on the future operating costs associated with the assets, the efficiency and

availability of the assets and generating units, and the future market and price for energy over the remaining life of

the assets.

River Bend AFUDC

The River Bend AFUDC gross-up is a regulatory asset that represents the incremental difference imputed by

the LPSC between the AFUDC actually recorded by Entergy Gulf States Louisiana on a net-of-tax basis during the

construction of River Bend and what the AFUDC would have been on a pre-tax basis. The imputed amount was

only calculated on that portion of River Bend that the LPSC allowed in rate base and is being amortized through

August 2025.

Reacquired Debt

The premiums and costs associated with reacquired debt of Entergy's Utility operating companies and

System Energy (except that portion allocable to the deregulated operations of Entergy Gulf States Louisiana) are

included in regulatory assets and are being amortized over the life of the related new issuances, in accordance with

ratemaking treatment.

73