Entergy 2009 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

120

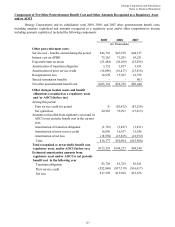

Other Postretirement Benefits

Entergy also currently provides health care and life insurance benefits for retired employees. Substantially

all employees may become eligible for these benefits if they reach retirement age while still working for Entergy.

Entergy uses a December 31 measurement date for its postretirement benefit plans.

Effective January 1, 1993, Entergy adopted an accounting standard requiring a change from a cash method

to an accrual method of accounting for postretirement other than pensions. At January 1, 1993, the actuarially

determined accumulated postretirement benefit obligation (APBO) earned by retirees and active employees was

estimated to be approximately $241.4 million for Entergy (other than the former Entergy Gulf States) and $128

million for the former Entergy Gulf States (now split into Entergy Gulf States Louisiana and Entergy Texas). Such

obligations are being amortized over a 20-year period that began in 1993. For the most part, the Registrant

Subsidiaries recover other postretirement benefit costs from customers and are required to contribute other

postretirement benefits collected in rates to an external trust.

Entergy Arkansas, Entergy Mississippi, Entergy New Orleans, and Entergy Texas have received regulatory

approval to recover other postretirement benefit costs through rates. Entergy Arkansas began recovery in 1998,

pursuant to an APSC order. This order also allowed Entergy Arkansas to amortize a regulatory asset (representing

the difference between other postretirement benefit costs and cash expenditures for other postretirement benefits

incurred for a five-year period that began January 1, 1993) over a 15-year period that began in January 1998.

The LPSC ordered Entergy Gulf States Louisiana and Entergy Louisiana to continue the use of the pay-as-

you-go method for ratemaking purposes for postretirement benefits other than pensions. However, the LPSC retains

the flexibility to examine individual companies' accounting for other postretirement benefits to determine if special

exceptions to this order are warranted.

Pursuant to regulatory directives, Entergy Arkansas, Entergy Mississippi, Entergy New Orleans, Entergy

Texas, and System Energy contribute the other postretirement benefit costs collected in rates into trusts. System

Energy is funding, on behalf of Entergy Operations, other postretirement benefits associated with Grand Gulf.

Trust assets contributed by participating Registrant Subsidiaries are in three bank-administered trusts,

established by Entergy Corporation and maintained by The Bank of New York Mellon (the Trustee). Each

participating Registrant Subsidiary holds a beneficial interest in the trusts’ assets. Use of these master trusts permits

the commingling of the trust assets for investment and administrative purposes. Although assets are commingled, the

Trustee maintains supporting records for the purpose of allocating the beneficial interest in net earnings (losses) and

the administrative expenses of the investment accounts to the various participating plans and participating Registrant

Subsidiaries. Beneficial interest in an investment account’ s net earnings (losses) is comprised of interest and

dividends and realized and unrealized gains and losses. Beneficial interest from these investments is allocated

monthly to the plans and participating Registrant Subsidiary based on its portion of net assets in the pooled accounts.

122