Entergy 2009 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Management's Financial Discussion and Analysis

7

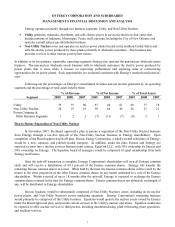

operator, as well as the transfers to Enexus of the ownership of Big Rock Point, FitzPatrick, Indian Point Units 1, 2

and 3, Palisades, Pilgrim, and Vermont Yankee. The approval for the proposed new ownership structure is now

effective until August 1, 2010. The review conducted by the NRC staff prior to approval of the license and

ownership transfers included matters such as the financial and technical qualifications of the new organizations, as

well as decommissioning funding assurance. In connection with the NRC approvals, Enexus agreed to enter into a

financial support agreement with the entities that own the nuclear power plants in the total amount of $700 million to

provide financial support, if needed, for the operating costs of the six operating Non-Utility Nuclear power plants.

FERC

Pursuant to Federal Power Act section 203, in February 2008 an application was filed with the FERC

requesting approval for the indirect disposition and transfer of control of jurisdictional facilities of a public utility.

The FERC issued an order in June 2008 authorizing the requested indirect disposition and transfer of control. In

August 2009 an amended application was filed with the FERC to reflect the transfer to the exchange trust by Entergy

of the 19.9 percent of Enexus' common stock shares. In September 2009 the FERC approved the amended

application.

Vermont

On January 28, 2008, Entergy Nuclear Vermont Yankee, LLC and Entergy Nuclear Operations, Inc.

requested approval from the Vermont Public Service Board (VPSB) for the indirect transfer of control, consent to

pledge assets, issue guarantees and assign material contracts, amendment to certificate of public good, and

replacement of guaranty and substitution of a credit support agreement for Vermont Yankee. Several parties

intervened in the proceeding. Discovery has been completed in this proceeding, in which parties could ask questions

about or request the production of documents related to the transaction.

In addition, the Vermont Department of Public Service (VDPS), which is the public advocate in proceedings

before the VPSB, prefiled its initial and rebuttal testimony in the case in which the VDPS took the position that

Entergy Nuclear Vermont Yankee and Entergy Nuclear Operations, Inc. have not demonstrated that the restructuring

promotes the public good because its benefits do not outweigh the risks, raising concerns that the target rating for

Enexus' debt is below investment grade and that the company may not have the financial capability to withstand

adverse financial developments, such as an extended outage. The VDPS testimony also expressed concern about the

EquaGen joint venture structure and Enexus' ability, under the operating agreement between Entergy Nuclear

Vermont Yankee and Entergy Nuclear Operations, Inc., to ensure that Vermont Yankee is well-operated. Two

distribution utilities that buy Vermont Yankee power prefiled testimony that also expressed concerns about the

structure but found that there was a small net benefit to the restructuring. The VPSB conducted hearings on July 28-

30, 2008, during which it considered the testimony prefiled by Entergy Nuclear Vermont Yankee, Entergy Nuclear

Operations, Inc., the VDPS, and the two distribution utilities. Subsequently, Entergy Nuclear Operations, Inc.

supplied supplemental data to the VPSB outlining the enhanced transaction structure detailed in the amended petition

filed in New York (discussed below). On October 8, 2009, a memorandum of understanding was filed with the

VPSB outlining an agreement reached with the VDPS, which, if approved by the VPSB, would result in approval of

the spin-off transaction in Vermont.

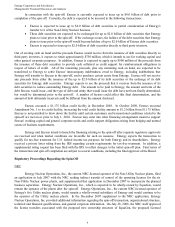

In connection with this memorandum of understanding, Enexus agreed to provide a $100 million working

capital facility to Entergy Nuclear Vermont Yankee and to obtain a $60 million letter of credit to fund operating

expenses after operations cease at Vermont Yankee. In addition, Enexus agreed that if it has not obtained a credit

rating of one notch below investment grade (e.g., a rating of BB+ by S&P) or higher by January 1, 2014, then

Enexus will furnish to Entergy Nuclear Vermont Yankee a second letter of credit in the amount of $50 million to

support Vermont Yankee's operations, which must be from a financial institution with a rating of A or higher from

S&P, or in the alternative, a financial institution with a similar rating from a nationally respected credit rating agency

that is of similar and appropriate credit quality. Entergy Nuclear Vermont Yankee and Entergy Nuclear Operations

have prefiled testimony explaining this memorandum of understanding and updating the VPSB on the financial

structure of the transactions and moved to amend their petition to include Enexus. To assist the VPSB in making its

9