Entergy 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

107

Vidalia Purchased Power Agreement

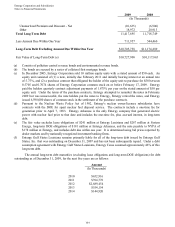

Entergy Louisiana has an agreement extending through the year 2031 to purchase energy generated by a

hydroelectric facility known as the Vidalia project. Entergy Louisiana made payments under the contract of

approximately $215.6 million in 2009, $167.7 million in 2008, and $130.8 million in 2007. If the maximum

percentage (94%) of the energy is made available to Entergy Louisiana, current production projections would require

estimated payments of approximately $169.8 million in 2010, and a total of $2.81 billion for the years 2011 through

2031. Entergy Louisiana currently recovers the costs of the purchased energy through its fuel adjustment clause. In

an LPSC-approved settlement related to tax benefits from the tax treatment of the Vidalia contract, Entergy

Louisiana agreed to credit rates by $11 million each year for up to ten years, beginning in October 2002. In addition,

in accordance with an LPSC settlement, Entergy Louisiana credited rates in August 2007 by $11.8 million (including

interest) as a result of a settlement with the IRS of the 2001 tax treatment of the Vidalia contract. The provisions of

the settlement also provide that the LPSC shall not recognize or use Entergy Louisiana's use of the cash benefits from

the tax treatment in setting any of Entergy Louisiana's rates. Therefore, to the extent Entergy Louisiana's use of the

proceeds would ordinarily have reduced its rate base, no change in rate base shall be reflected for ratemaking

purposes.

Nuclear Insurance

Third Party Liability Insurance

The Price-Anderson Act requires that reactor licensees purchase insurance and participate in a secondary

insurance pool that provides insurance coverage for the public in the event of a nuclear power plant accident. The

costs of this insurance are borne by the nuclear power industry. Congress amended and renewed the Price-Anderson

Act in 2005 for a term through 2025. The Price-Anderson Act requires nuclear power plants to show evidence of

financial protection in the event of a nuclear accident. This protection must consist of two layers of coverage:

1. The primary level is private insurance underwritten by American Nuclear Insurers and provides public

liability insurance coverage of $375 million. If this amount is not sufficient to cover claims arising from an

accident, the second level, Secondary Financial Protection, applies.

2. Within the Secondary Financial Protection level, each nuclear reactor has a contingent obligation to pay a

retrospective premium, equal to its proportionate share of the loss in excess of the primary level, regardless

of proximity to the incident or fault, up to a maximum of $117.5 million per reactor per incident (Entergy's

maximum total contingent obligation per incident is $1.3 billion). This consists of a $111.9 million

maximum retrospective premium plus a five percent surcharge, which equates to $117.5 million, that may be

payable, if needed, at a rate that is currently set at $17.5 million per year per nuclear power reactor. A $300

million industry-wide aggregate limit exists for domestically-sponsored terrorist acts. There is no aggregate

limitation for foreign-sponsored terrorist acts.

Currently, 104 nuclear reactors are participating in the Secondary Financial Protection program. The

product of the maximum retrospective premium assessment to the nuclear power industry and the number of nuclear

power reactors provides over $12.2 billion in secondary layer insurance coverage to compensate the public in the

event of a nuclear power reactor accident. The Price-Anderson Act provides that all potential liability for a nuclear

accident is limited to the amounts of insurance coverage available under the primary and secondary layers.

Entergy Arkansas has two licensed reactors and Entergy Gulf States Louisiana, Entergy Louisiana, and

System Energy each have one licensed reactor (10% of Grand Gulf is owned by a non-affiliated company (SMEPA)

that would share on a pro-rata basis in any retrospective premium assessment to System Energy under the Price-

Anderson Act). Entergy's Non-Utility Nuclear business owns and operates six nuclear power reactors and owns the

shutdown Indian Point 1 reactor and Big Rock Point facility.

109