Entergy 2009 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Management's Financial Discussion and Analysis

13

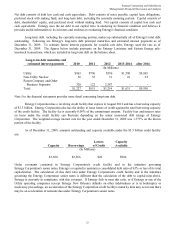

outpacing new unit additions. The majority of the existing long-term contracts for power from these four plants

expire by the end of 2012. The recent economic downturn and negative trends in the energy commodity markets have

resulted in lower natural gas prices and therefore current prevailing market prices for electricity in the New York and

New England power regions are generally below the prices in Non-Utility Nuclear's existing contracts in those

regions. Therefore, it is uncertain whether Non-Utility Nuclear will continue to experience increases in its annual

realized price per MWh or what contract prices for power Non-Utility Nuclear will be able to obtain as its existing

long-term contracts expire. As shown in the contracted sale of energy table in "Market and Credit Risk Sensitive

Instruments," Non-Utility Nuclear has sold forward 88% of its planned energy output in 2010 for an average

contracted energy price of $57 per MWh.

Other Income Statement Items

Utility

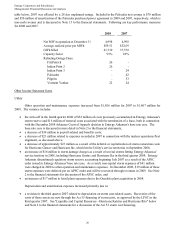

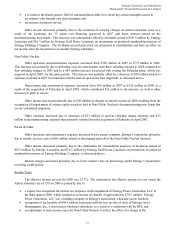

Other operation and maintenance expenses decreased from $1,867 million for 2008 to $1,837 million for

2009. The variance includes the following:

a decrease due to the write-off in the fourth quarter 2008 of $52 million of costs previously accumulated in

Entergy Arkansas's storm reserve and $16 million of removal costs associated with the termination of a lease,

both in connection with the December 2008 Arkansas Court of Appeals decision in Entergy Arkansas's base

rate case. The base rate case is discussed in more detail in Note 2 to the financial statements;

a decrease due to the capitalization of Ouachita plant service charges of $12.5 million previously expensed;

a decrease of $22 million in loss reserves in 2009, including a decrease in storm damage reserves as a result

of the completion of the Act 55 storm cost financing at Entergy Gulf States Louisiana and Entergy

Louisiana;

a decrease of $16 million in payroll-related and benefits costs;

prior year storm damage charges as a result of several storms hitting Entergy Arkansas' service territory in

2008, including Hurricane Gustav and Hurricane Ike in the third quarter 2008. Entergy Arkansas

discontinued regulatory storm reserve accounting beginning July 2007 as a result of the APSC order issued

in Entergy Arkansas' rate case. As a result, non-capital storm expenses of $41 million were charged to other

operation and maintenance expenses. In December 2008, $19.4 million of these storm expenses were

deferred per an APSC order and were recovered through revenues in 2009;

an increase of $35 million in fossil expenses primarily due to higher plant maintenance costs and plant

outages;

an increase of $22 million in nuclear expenses primarily due to increased nuclear labor and contract costs;

an increase of $14 million due to the reinstatement of storm reserve accounting at Entergy Arkansas effective

January 2009;

an increase of $14 million due to the Hurricane Ike and Hurricane Gustav storm cost recovery settlement

agreement, as discussed below under "Liquidity and Capital Resources - Sources of Capital - Hurricane

Gustav and Hurricane Ike";

an increase of $8 million in customer service costs primarily as a result of write-offs of uncollectible

customer accounts; and

a reimbursement of $7 million of costs in 2008 in connection with a litigation settlement.

Depreciation and amortization expenses increased primarily due to an increase in plant in service.

Other income increased primarily due to:

an increase in distributions of $25 million earned by Entergy Louisiana and $9 million earned by Entergy

Gulf States Louisiana on investments in preferred membership interests of Entergy Holdings Company. The

distributions on preferred membership interests are eliminated in consolidation and have no effect on

Entergy's net income because the investment is in another Entergy subsidiary. See Note 2 to the financial

statements for a discussion of these investments in preferred membership interests;

15