Entergy 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

67

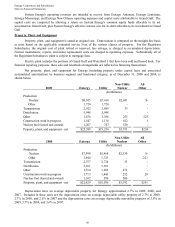

"Non-utility property - at cost (less accumulated depreciation)" for Entergy is reported net of accumulated

depreciation of $197.8 million and $185.8 million as of December 31, 2009 and 2008, respectively.

Construction expenditures included in accounts payable at December 31, 2009 is $159.8 million.

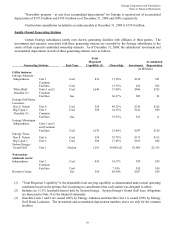

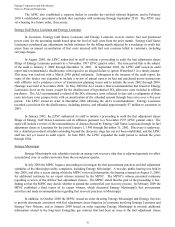

Jointly-Owned Generating Stations

Certain Entergy subsidiaries jointly own electric generating facilities with affiliates or third parties. The

investments and expenses associated with these generating stations are recorded by the Entergy subsidiaries to the

extent of their respective undivided ownership interests. As of December 31, 2009, the subsidiaries' investment and

accumulated depreciation in each of these generating stations were as follows:

Generating Stations Fuel-Type

Total

Megawatt

Capability (1) Ownership Investment

Accumulated

Depreciation

(In Millions)

Utility business:

Entergy Arkansas -

Independence Unit 1 Coal 836 31.50% $128 $91

Common

Facilities Coal 15.75% $32 $23

White Bluff Units 1 and 2 Coal 1,640 57.00% $486 $323

Ouachita (3) Common

Facilities Gas 66.67% $29 $1

Entergy Gulf States

Louisiana -

Roy S. Nelson Unit 6 Coal 550 40.25% $236 $162

Big Cajun 2 Unit 3 Coal 588 24.15% $141 $89

Ouachita (3) Common

Facilities Gas 33.33% $13 $-

Entergy Mississippi -

Independence Units 1 and 2

and Common

Facilities Coal 1,678 25.00% $247 $129

Entergy Texas -

Roy S. Nelson Unit 6 Coal 550 29.75% $173 $115

Big Cajun 2 Unit 3 Coal 588 17.85% $105 $66

System Energy -

Grand Gulf Unit 1 Nuclear 1,210 90.00%(2) $3,806 $2,315

Non-nuclear

wholesale assets:

Independence Unit 2 Coal 842 14.37% $74 $39

Common

Facilities Coal 7.18% $15 $14

Harrison County Gas 550 60.90% $207 $29

(1)

"Total Megawatt Capability" is the dependable load carrying capability as demonstrated under actual operating

conditions based on the primary fuel (assuming no curtailments) that each station was designed to utilize.

(2) Includes an

11.5% leasehold interest held by System Energy. System Energy's Grand Gulf lease obligations

are discussed in Note 10 to the financial statements.

(3)

Ouachita Units 1 and 2 are owned 100% by Entergy Arkansas and Ouachita Unit 3 is owned 100% by Entergy

Gulf States Louisiana.

The investment and accumulated depreciation numbers above are only for the common

facilities.

69