Entergy 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

98

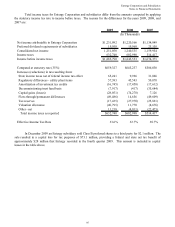

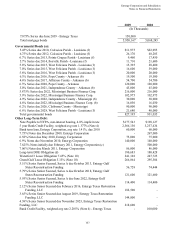

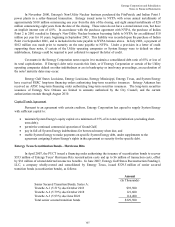

Entergy Arkansas, Entergy Gulf States Louisiana, Entergy Louisiana, Entergy Mississippi, and Entergy

Texas each had credit facilities available as of December 31, 2009 as follows:

Company Expiration Date

Amount of

Facility Interest Rate (a)

Amount Drawn

as of

December 31, 2009

Entergy Arkansas April 2010 $88 million (b) 5.00% -

Entergy Gulf States Louisiana August 2012 $100 million (c) 0.71% -

Entergy Louisiana August 2012 $200 million (d) 0.64% -

Entergy Mississippi May 2010 $35 million (e) 1.98% -

Entergy Mississippi May 2010 $25 million (e) 1.98% -

Entergy Mississippi May 2010 $10 million (e) 1.91% -

Entergy Texas August 2012 $100 million (f) 0.71% -

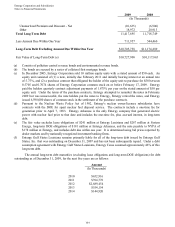

(a) The interest rate is the weighted average interest rate as of December 31, 2009 applied or that would be applied to

the outstanding borrowings under the facility.

(b) The credit facility requires Entergy Arkansas to maintain a debt ratio of 65% or less of its total capitalization and

contains an interest rate floor of 5%. Borrowings under the Entergy Arkansas credit facility may be secured by a

security interest in its accounts receivable.

(c) The credit facility allows Entergy Gulf States Louisiana to issue letters of credit against the borrowing capacity of

the facility. As of December 31, 2009, no letters of credit were outstanding. The credit facility requires Entergy

Gulf States Louisiana to maintain a consolidated debt ratio of 65% or less of its total capitalization. Pursuant to

the terms of the credit agreement, the amount of debt assumed by Entergy Texas ($168 million as of December 31,

2009 and $770 million as of December 31, 2008) is excluded from debt and capitalization in calculating the debt

ratio.

(d) The credit facility allows Entergy Louisiana to issue letters of credit against the borrowing

capacity of the facility.

As of December 31, 2009, no letters of credit were outstanding. The credit facility requires Entergy Louisiana to

maintain a consolidated debt ratio of 65% or less of its total capitalization.

(e) Borrowings under the Entergy Mississippi credit facilities may be secured by a security interest in its accounts

receivable. Entergy Mississippi is required to maintain a consolidated debt ratio of 65% or less of its total

capitalization.

(f) The credit facility allows Entergy Texas to issue letters of credit against the borrowing capacity of the facility. As

of December 31, 2009, no letters of credit were outstanding. The credit facility requires Entergy Texas to maintain

a consolidated debt ratio of 65% or less of its total capitalization. Pursuant to the terms of the credit agreement

securitization bonds are excluded from debt and capitalization in calculating the debt ratio.

The facility fees on the credit facilities range from 0.09% to 0.15% of the commitment amount.

100