Entergy 2009 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

145

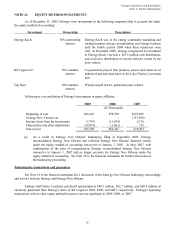

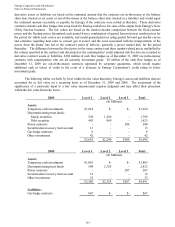

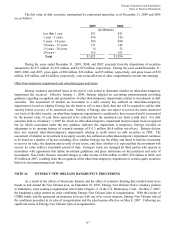

The fair value of debt securities, summarized by contractual maturities, as of December 31, 2009 and 2008

are as follows:

2009 2008

(In Millions)

less than 1 year $31 $21

1 year - 5 years 676 526

5 years - 10 years 388 490

10 years - 15 years 131 146

15 years - 20 years 34 52

20 years+ 163 161

Total $1,423 $1,396

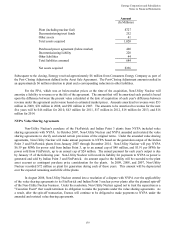

During the years ended December 31, 2009, 2008, and 2007, proceeds from the dispositions of securities

amounted to $2,571 million, $1,652 million, and $1,583 million, respectively. During the years ended December 31,

2009, 2008, and 2007, gross gains of $80 million, $26 million, and $5 million, respectively, and gross losses of $30

million, $20 million, and $4 million, respectively, were reclassified out of other comprehensive income into earnings.

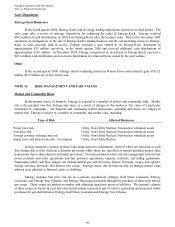

Other-than-temporary impairments and unrealized gains and losses

Entergy evaluates unrealized losses at the end of each period to determine whether an other-than-temporary

impairment has occurred. Effective January 1, 2009, Entergy adopted an accounting pronouncement providing

guidance regarding recognition and presentation of other-than-temporary impairments related to investments in debt

securities. The assessment of whether an investment in a debt security has suffered an other-than-temporary

impairment is based on whether Entergy has the intent to sell or more likely than not will be required to sell the debt

security before recovery of its amortized costs. Further, if Entergy does not expect to recover the entire amortized

cost basis of the debt security, an other-than-temporary impairment is considered to have occurred and it is measured

by the present value of cash flows expected to be collected less the amortized cost basis (credit loss). For debt

securities held as of January 1, 2009 for which an other-than-temporary impairment had previously been recognized

but for which assessment under the new guidance indicates this impairment is temporary, Entergy recorded an

adjustment to its opening balance of retained earnings of $11.3 million ($6.4 million net-of-tax). Entergy did not

have any material other-than-temporary impairments relating to credit losses on debt securities in 2009. The

assessment of whether an investment in an equity security has suffered an other-than-temporary impairment continues

to be based on a number of factors including, first, whether Entergy has the ability and intent to hold the investment

to recover its value, the duration and severity of any losses, and, then, whether it is expected that the investment will

recover its value within a reasonable period of time. Entergy's trusts are managed by third parties who operate in

accordance with agreements that define investment guidelines and place restrictions on the purchases and sales of

investments. Non-Utility Nuclear recorded charges to other income of $86 million in 2009, $50 million in 2008, and

$5 million in 2007, resulting from the recognition of the other-than-temporary impairment of certain equity securities

held in its decommissioning trust funds.

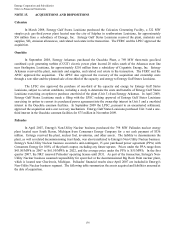

NOTE 18. ENTERGY NEW ORLEANS BANKRUPTCY PROCEEDING

As a result of the effects of Hurricane Katrina and the effect of extensive flooding that resulted from levee

breaks in and around the New Orleans area, on September 23, 2005, Entergy New Orleans filed a voluntary petition

in bankruptcy court seeking reorganization relief under Chapter 11 of the U.S. Bankruptcy Code. On May 7, 2007,

the bankruptcy judge entered an order confirming Entergy New Orleans' plan of reorganization. With the receipt of

CDBG funds, and the agreement on insurance recovery with one of its excess insurers, Entergy New Orleans waived

the conditions precedent in its plan of reorganization and the plan became effective on May 8, 2007. Following are

significant terms in Entergy New Orleans' plan of reorganization:

147