Entergy 2009 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Management's Financial Discussion and Analysis

19

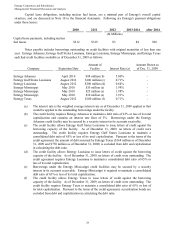

a revision in the fourth quarter 2008 of estimated depreciable lives involving certain intangible assets in

accordance with formula rate plan treatment; and

an increase in plant in service.

Other income decreased primarily due to the cessation of carrying charges on storm restoration costs as a

result of the Louisiana Act 55 storm cost financing approved in 2007 and lower interest earned on the

decommissioning trust funds. This decrease was substantially offset by dividends earned of $29.5 million by Entergy

Louisiana and $10.3 million by Entergy Gulf States Louisiana on investments in preferred membership interests of

Entergy Holdings Company. The dividends on preferred stock are eliminated in consolidation and have no effect on

net income since the investment is in another Entergy subsidiary.

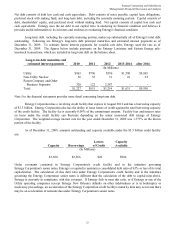

Non-Utility Nuclear

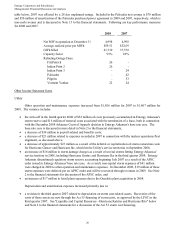

Other operation and maintenance expenses increased from $760 million in 2007 to $773 million in 2008.

This increase was primarily due to deferring costs for amortization from three refueling outages in 2008 compared to

four refueling outages in 2007 and to a $34 million increase associated with owning the Palisades plant, which was

acquired in April 2007, for the entire period. The increase was partially offset by a decrease of $29 million related to

expenses recorded in 2007 in connection with the nuclear operations fleet alignment, as discussed above.

Depreciation and amortization expenses increased from $99 million in 2007 to $126 million in 2008 as a

result of the acquisition of Palisades in April 2007, which contributed $12 million to the increase, as well as other

increases in plant in service.

Other income decreased primarily due to $50 million in charges to interest income in 2008 resulting from the

recognition of impairments of certain equity securities held in Non-Utility Nuclear's decommissioning trust funds that

are not considered temporary.

Other expenses increased due to increases of $23 million in nuclear refueling outage expenses and $15

million in decommissioning expenses that primarily resulted from the acquisition of Palisades in April 2007.

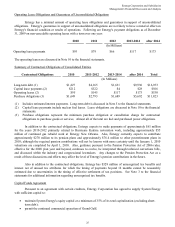

Parent & Other

Other operation and maintenance expenses increased for the parent company, Entergy Corporation, primarily

due to outside services costs of $69 million related to the planned spin-off of the Non-Utility Nuclear business.

Other income decreased primarily due to the elimination for consolidation purposes of dividends earned of

$29.5 million by Entergy Louisiana and $10.3 million by Entergy Gulf States Louisiana on investments in preferred

membership interests of Entergy Holdings Company, as discussed above.

Interest charges decreased primarily due to lower interest rates on borrowings under Entergy Corporation's

revolving credit facility.

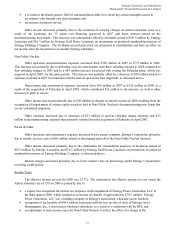

Income Taxes

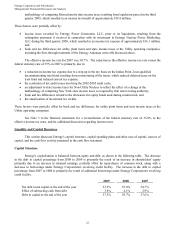

The effective income tax rate for 2008 was 32.7%. The reduction in the effective income tax rate versus the

federal statutory rate of 35% in 2008 is primarily due to:

a capital loss recognized for income tax purposes on the liquidation of Entergy Power Generation, LLC in

the third quarter 2008, which resulted in an income tax benefit of approximately $79.5 million. Entergy

Power Generation, LLC was a holding company in Entergy's non-nuclear wholesale assets business;

recognition of tax benefits of $44.3 million associated with the loss on sale of stock of Entergy Asset

Management, Inc., a non-nuclear wholesale subsidiary, as a result of a settlement with the IRS; and

an adjustment to state income taxes for Non-Utility Nuclear to reflect the effect of a change in the

21