Entergy 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

66

System Energy's operating revenues are intended to recover from Entergy Arkansas, Entergy Louisiana,

Entergy Mississippi, and Entergy New Orleans operating expenses and capital costs attributable to Grand Gulf. The

capital costs are computed by allowing a return on System Energy's common equity funds allocable to its net

investment in Grand Gulf, plus System Energy's effective interest cost for its debt allocable to its investment in Grand

Gulf.

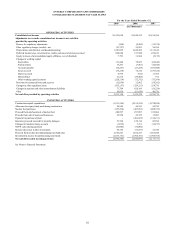

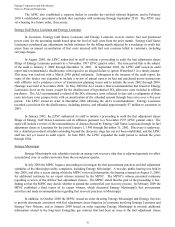

Property, Plant, and Equipment

Property, plant, and equipment is stated at original cost. Depreciation is computed on the straight-line basis

at rates based on the applicable estimated service lives of the various classes of property. For the Registrant

Subsidiaries, the original cost of plant retired or removed, less salvage, is charged to accumulated depreciation.

Normal maintenance, repairs, and minor replacement costs are charged to operating expenses. Substantially all of

the Registrant Subsidiaries' plant is subject to mortgage liens.

Electric plant includes the portions of Grand Gulf and Waterford 3 that have been sold and leased back. For

financial reporting purposes, these sale and leaseback arrangements are reflected as financing transactions.

Net property, plant, and equipment for Entergy (including property under capital lease and associated

accumulated amortization) by business segment and functional category, as of December 31, 2009 and 2008, is

shown below:

2009 Entergy Utility

Non-Utility

Nuclear

All

Other

(In Millions)

Production

Nuclear $8,105 $5,414 $2,691 $-

Other 1,724 1,724 - -

Transmission 2,922 2,889 33 -

Distribution 5,948 5,948 - -

Other 1,876 1,398 255 223

Construction work in progress 1,547 1,134 412 1

Nuclear fuel (leased and owned) 1,267 747 520 -

Property, plant, and equipment - net $23,389 $19,254 $3,911 $224

2008 Entergy Utility

Non-Utility

Nuclear

All

Other

(In Millions)

Production

Nuclear $7,998 $5,468 $2,530 $-

Other 1,944 1,723 - 221

Transmission 2,757 2,724 33 -

Distribution 5,361 5,361 - -

Other 1,554 1,283 271 -

Construction work in progress 1,713 1,441 252 20

Nuclear fuel (leased and owned) 1,102 596 506 -

Property, plant, and equipment - net $22,429 $18,596 $3,592 $241

Depreciation rates on average depreciable property for Entergy approximated 2.7% in 2009, 2008, and

2007. Included in these rates are the depreciation rates on average depreciable utility property of 2.7% in 2009,

2.7% in 2008, and 2.6% in 2007 and the depreciation rates on average depreciable non-utility property of 3.8% in

2009, 3.7% in 2008, and 3.6% in 2007.

68