Entergy 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Management's Financial Discussion and Analysis

51

Entergy's funding and reported costs for these benefits. In addition, these trends have caused Entergy to make a

number of adjustments to its assumptions.

In selecting an assumed discount rate to calculate benefit obligations, Entergy reviews market yields on high-

quality corporate debt and matches these rates with Entergy's projected stream of benefit payments. Based on recent

market trends, Entergy decreased the discount rate used to calculate its qualified pension benefit obligation from an

average rate of 6.75% in 2008 to specific rates by plan ranging from 6.10% to 6.30% in 2009. The discount rate

used to calculate its other postretirement benefit obligation was also decreased from 6.7% in 2008 to 6.10% in 2009.

Entergy's assumed discount rate used to calculate the 2007 pension and other postretirement benefit obligations was

6.50%.

Entergy reviews actual recent cost trends and projected future trends in establishing health care cost trend

rates. Based on this review, Entergy's health care cost trend rate assumption used in calculating the December 31,

2009 accumulated postretirement benefit obligation was a 7.5% increase in health care costs in 2010 gradually

decreasing each successive year, until it reaches a 4.75% annual increase in health care costs in 2016 and beyond.

In determining its expected long-term rate of return on plan assets, Entergy reviews past long-term

performance, asset allocations, and long-term inflation assumptions. Entergy targets an asset allocation for its

qualified pension plan assets of roughly 65% equity securities and 35% fixed-income securities. The target

allocations for Entergy's non-taxable postretirement benefit assets are 55% equity securities and 45% fixed-income

securities and, for its taxable other postretirement benefit assets, 35% equity securities and 65% fixed-income

securities. Entergy's expected long-term rate of return on qualified pension assets and non-taxable other

postretirement assets used to calculate 2009, 2008, and 2007 qualified pension and other postretirement benefits

costs was 8.5%. Entergy's expected long-term rate of return on taxable other postretirement assets was 6% in 2009

and 5.5% in 2008 and 2007.

The assumed rate of increase in future compensation levels used to calculate benefit obligations was 4.23%

in 2009, 2008, and 2007.

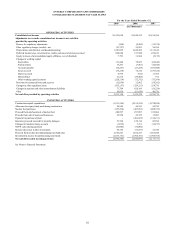

Cost Sensitivity

The following chart reflects the sensitivity of qualified pension cost to changes in certain actuarial

assumptions (dollars in thousands):

Actuarial Assumption

Change in

Assumption

Impact on 2009

Qualified Pension

Cost

Impact on Qualified

Projected

Benefit Obligation

Increase/(Decrease)

Discount rate (0.25%) $12,192 $117,856

Rate of return on plan assets (0.25%) $7,331 -

Rate of increase in compensation 0.25% $6,311 $30,817

The following chart reflects the sensitivity of postretirement benefit cost to changes in certain actuarial

assumptions (dollars in thousands):

Actuarial Assumption

Change in

Assumption

Impact on 2009

Postretirement Benefit Cost

Impact on Accumulated

Postretirement Benefit

Obligation

Increase/(Decrease)

Health care cost trend 0.25% $6,073 $31,981

Discount rate (0.25%) $4,109 $37,324

Each fluctuation above assumes that the other components of the calculation are held constant.

53