Entergy 2009 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

140

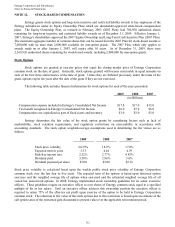

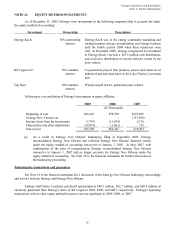

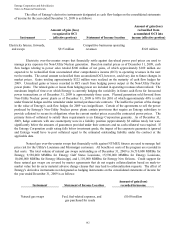

The effect of Entergy's derivative instruments designated as cash flow hedges on the consolidated statements

of income for the year ended December 31, 2009 is as follows:

Instrument

Amount of gain (loss)

recognized in OCI

(effective portion) Statement of Income location

Amount of gain (loss)

reclassified from

accumulated OCI into

income (effective portion)

Electricity futures, forwards,

and swaps $315 million

Competitive businesses operating

revenues $322 million

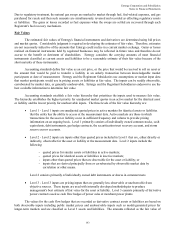

Electricity over-the-counter swaps that financially settle against day-ahead power pool prices are used to

manage price exposure for Non-Utility Nuclear generation. Based on market prices as of December 31, 2009, cash

flow hedges relating to power sales totaled $200 million of net gains, of which approximately $109 million are

expected to be reclassified from accumulated other comprehensive income (OCI) to operating revenues in the next

twelve months. The actual amount reclassified from accumulated OCI, however, could vary due to future changes in

market prices. Gains totaling approximately $322 million were realized on the maturity of cash flow hedges for

2009. Unrealized gains or losses recorded in OCI result from hedging power output at the Non-Utility Nuclear

power plants. The related gains or losses from hedging power are included in operating revenues when realized. The

maximum length of time over which Entergy is currently hedging the variability in future cash flows for forecasted

power transactions as of December 31, 2009 is approximately three years. Planned generation sold forward from

Non-Utility Nuclear power plants as of December 31, 2009 is 88% for 2010 of which approximately 40% is sold

under financial hedges and the remainder under normal purchase/sale contracts. The ineffective portion of the change

in the value of Entergy's cash flow hedges for 2009 was insignificant. Certain of the agreements to sell the power

produced by Entergy's Non-Utility Nuclear power plants contain provisions that require an Entergy subsidiary to

provide collateral to secure its obligations when the current market prices exceed the contracted power prices. The

primary form of collateral to satisfy these requirements is an Entergy Corporation guaranty. As of December 31,

2009, hedge contracts with one counterparty were in a liability position (approximately $2 million total), but were

significantly below the amounts of guarantees provided under their contracts and no cash collateral was required. If

the Entergy Corporation credit rating falls below investment grade, the impact of the corporate guarantee is ignored

and Entergy would have to post collateral equal to the estimated outstanding liability under the contract at the

applicable date.

Natural gas over-the-counter swaps that financially settle against NYMEX futures are used to manage fuel

price risk for the Utility's Louisiana and Mississippi customers. All benefits or costs of the program are recorded in

fuel costs. The total volume of natural gas swaps outstanding as of December 31, 2009 is 36,710,000 MMBtu for

Entergy, 9,530,000 MMBtu for Entergy Gulf States Louisiana, 15,590,000 MMBtu for Entergy Louisiana,

10,480,000 MMBtu for Entergy Mississippi, and 1,110,000 MMBtu for Entergy New Orleans. Credit support for

these natural gas swaps are covered by master agreements that do not require collateralization based on mark-to-

market value but do carry material adverse change clauses that may lead to collateralization requests. The effect of

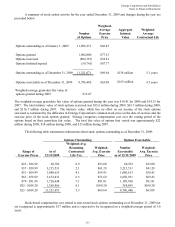

Entergy's derivative instruments not designated as hedging instruments on the consolidated statements of income for

the year ended December 31, 2009 is as follows:

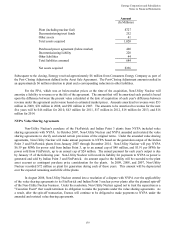

Instrument Statement of Income Location

Amount of gain (loss)

recorded in income

Natural gas swaps Fuel, fuel-related expenses, and

gas purchased for resale

($160) million

142