Entergy 2009 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

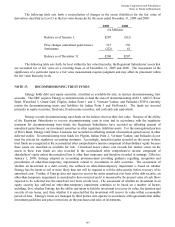

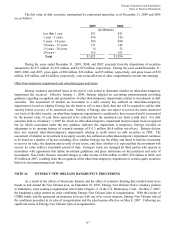

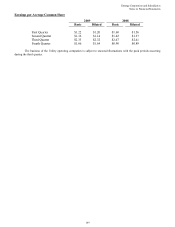

Entergy Corporation and Subsidiaries

Notes to Financial Statements

138

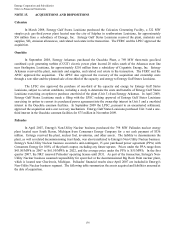

Asset Dispositions

Entergy-Koch Businesses

In the fourth quarter 2004, Entergy-Koch sold its energy trading and pipeline businesses to third parties. The

sales came after a review of strategic alternatives for enhancing the value of Entergy-Koch. Entergy received

$862 million of cash distributions in 2004 from Entergy-Koch after the business sales. Due to the November 2006

expiration of contingencies on the sale of Entergy-Koch's trading business, and the corresponding release to Entergy-

Koch of sales proceeds held in escrow, Entergy recorded a gain related to its Entergy-Koch investment of

approximately $55 million, net-of-tax, in the fourth quarter 2006 and received additional cash distributions of

approximately $163 million. In December 2009, Entergy reorganized its investment in Entergy-Koch, received a

$25.6 million cash distribution, and received a distribution of certain software owned by the joint venture.

Other

In the second quarter 2008, Entergy sold its remaining interest in Warren Power and realized a gain of $11.2

million ($6.9 million net-of-tax) on the sale.

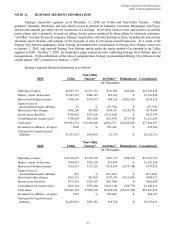

NOTE 16. RISK MANAGEMENT AND FAIR VALUES

Market and Commodity Risks

In the normal course of business, Entergy is exposed to a number of market and commodity risks. Market

risk is the potential loss that Entergy may incur as a result of changes in the market or fair value of a particular

instrument or commodity. All financial and commodity-related instruments, including derivatives, are subject to

market risk. Entergy is subject to a number of commodity and market risks, including:

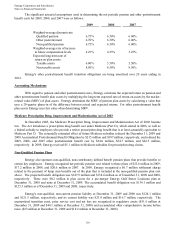

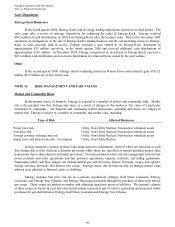

Type of Risk Affected Businesses

Power price risk Utility, Non-Utility Nuclear, Non-nuclear wholesale assets

Fuel price risk Utility, Non-Utility Nuclear, Non-nuclear wholesale assets

Foreign currency exchange rate risk Utility, Non-Utility Nuclear, Non-nuclear wholesale assets

Equity price and interest rate risk - investments Utility, Non-Utility Nuclear

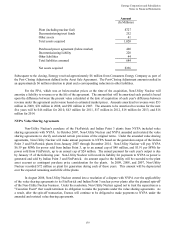

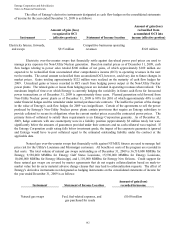

Entergy manages a portion of these risks using derivative instruments, some of which are classified as cash

flow hedges due to their financial settlement provisions while others are classified as normal purchase/normal sales

transactions due to their physical settlement provisions. Normal purchase/normal sale risk management tools include

power purchase and sales agreements and fuel purchase agreements, capacity contracts, and tolling agreements.

Financially-settled cash flow hedges can include natural gas and electricity futures, forwards, swaps, and options;

foreign currency forwards; and interest rate swaps. Entergy enters into derivatives only to manage natural risks

inherent in its physical or financial assets or liabilities.

Entergy manages fuel price risk for its Louisiana jurisdictions (Entergy Gulf States Louisiana, Entergy

Louisiana, and Entergy New Orleans) and Entergy Mississippi primarily through the purchase of short-term natural

gas swaps. These swaps are marked-to-market with offsetting regulatory assets or liabilities. The notional volumes

of these swaps are based on a portion of projected annual exposure to gas for electric generation and projected winter

purchases for gas distribution at Entergy Gulf States Louisiana and Entergy New Orleans.

140