Entergy 2009 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Management's Financial Discussion and Analysis

14

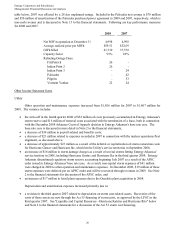

carrying charges of $35 million on Hurricane Ike storm restoration costs as authorized by Texas legislation

in the second quarter 2009;

an increase of $15 million in allowance for equity funds used during construction due to more construction

work in progress primarily as a result of Hurricane Gustav and Hurricane Ike; and

a gain of $16 million recorded on the sale of undeveloped real estate by Entergy Louisiana Properties, LLC.

These increases in other income were partially offset by a decrease of $14 million in taxes collected on advances for

transmission projects and a decrease of $18 million resulting from lower interest earned on the decommissioning trust

funds and short-term investments.

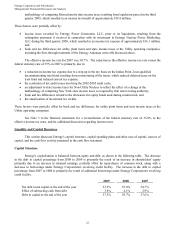

Interest charges increased primarily due to an increase in long-term debt outstanding resulting from debt

issuances by certain of the Utility operating companies in the second half of 2008 and in 2009.

Non-Utility Nuclear

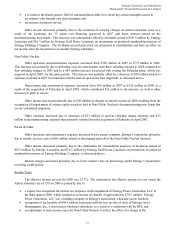

Other operation and maintenance expenses increased from $773 million in 2008 to $849 million in 2009

primarily due to $46 million in outside service costs and incremental labor costs related to the planned spin-off of the

Non-Utility Nuclear business. Also contributing to the increase were higher nuclear labor and regulatory costs.

Other income increased primarily due to increases in interest income and realized earnings from the

decommissioning trust funds and interest income from loans to Entergy subsidiaries. These increases were partially

offset by $86 million in charges in 2009 compared to $50 million in charges in 2008 resulting from the recognition of

impairments of certain equity securities held in Non-Utility Nuclear's decommissioning trust funds that are not

considered temporary.

Parent & Other

Other operation and maintenance expenses decreased for the parent company, Entergy Corporation,

primarily due to a decrease in outside services costs of $38 million related to the planned spin-off of the Non-Utility

Nuclear business.

Other income decreased primarily due to:

an increase in the elimination for consolidation purposes of interest income from Entergy subsidiaries; and

increases in the elimination for consolidation purposes of distributions earned of $25 million by Entergy

Louisiana and $9 million by Entergy Gulf States Louisiana on investments in preferred membership interests

of Entergy Holdings Company, as discussed above.

Interest charges decreased primarily due to lower interest rates on borrowings under Entergy Corporation's

revolving credit facility.

Income Taxes

The effective income tax rate for 2009 was 33.6%. The reduction in the effective income tax rate versus the

federal statutory rate of 35% in 2009 is primarily due to:

a tax benefit of approximately $28 million recognized on a capital loss resulting from the sale of

preferred stock of Entergy Asset Management, Inc., a non-nuclear wholesale subsidiary, to a third

party;

the recognition of state loss carryovers in the amount of $24.3 million that had been subject to a

valuation allowance;

the recognition of a federal capital loss carryover of $16.2 million that had been subject to a valuation

allowance;

16