Entergy 2009 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

144

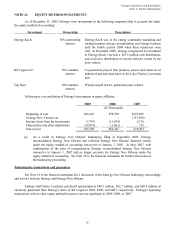

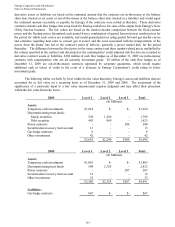

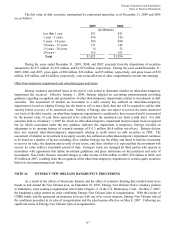

The securities held as of December 31, 2009 and 2008 are summarized as follows:

Fair

Value

Total

Unrealized

Gains

Total

Unrealized

Losses

(In Millions)

2009

Equity Securities $1,788 $311 $30

Debt Securities 1,423 63 8

Total $3,211 $374 $38

2008

Equity Securities $1,436 $85 $177

Debt Securities 1,396 77 21

Total $2,832 $162 $198

The amortized cost of debt securities was $1,368 million as of December 31, 2009 and $1,340 million as of

December 31, 2008. As of December 31, 2009, the debt securities have an average coupon rate of approximately

4.68%, an average duration of approximately 5.08 years, and an average maturity of approximately 8.3 years. The

equity securities are generally held in funds that are designed to approximate or somewhat exceed the return of the

Standard & Poor's 500 Index. A relatively small percentage of the securities are held in funds intended to replicate

the return of the Wilshire 4500 Index or the Russell 3000 Index.

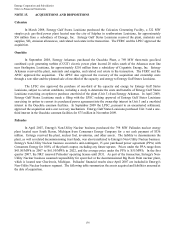

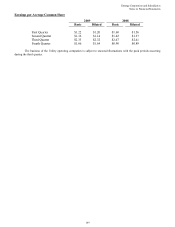

The fair value and gross unrealized losses of available-for-sale equity and debt securities, summarized by

investment type and length of time that the securities have been in a continuous loss position, are as follows as of

December 31, 2009:

Equity Securities Debt Securities

Fair

Value

Gross

Unrealized

Losses

Fair

Value

Gross

Unrealized

Losses

(In Millions)

Less than 12 months $57 $1 $311 $6

More than 12 months 205 29 18 2

Total $262 $30 $329 $8

The unrealized losses in excess of twelve months above relate to Entergy's Utility operating companies and System

Energy.

146