Entergy 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

111

These liabilities are recorded at their fair values (which are the present values of the estimated future cash

outflows) in the period in which they are incurred, with an accompanying addition to the recorded cost of the long-

lived asset. The asset retirement obligation is accreted each year through a charge to expense, to reflect the time

value of money for this present value obligation. The accretion will continue through the completion of the asset

retirement activity. The amounts added to the carrying amounts of the long-lived assets will be depreciated over the

useful lives of the assets. The application of accounting standards related to asset retirement obligations is earnings

neutral to the rate-regulated business of the Registrant Subsidiaries.

In accordance with ratemaking treatment and as required by regulatory accounting standards, the

depreciation provisions for the Registrant Subsidiaries include a component for removal costs that are not asset

retirement obligations under accounting standards. In accordance with regulatory accounting principles, the

Registrant Subsidiaries have recorded regulatory assets (liabilities) in the following amounts to reflect their estimates

of the difference between estimated incurred removal costs and estimated removal costs recovered in rates:

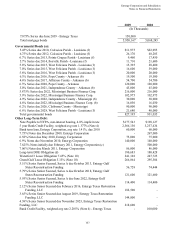

December 31,

2009 2008

(In Millions)

Entergy Arkansas ($7.3) $5.9

Entergy Gulf States Louisiana ($7.5) ($3.6)

Entergy Louisiana ($21.7) ($43.5)

Entergy Mississippi $44.5 $40.0

Entergy New Orleans $15.2 $15.4

Entergy Texas $7.2 $34.7

System Energy $13.9 $14.5

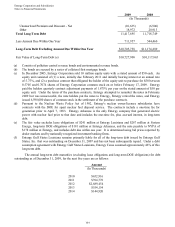

The cumulative decommissioning and retirement cost liabilities and expenses recorded in 2009 by Entergy

were as follows:

Liabilities as of

December 31, 2008 Accretion

Change in

Cash Flow

Estimate Spending

Liabilities as of

December 31, 2009

(In Millions)

Utility:

Entergy Arkansas $540.7 $34.6 ($8.9) $- $566.4

Entergy Gulf States

Louisiana $222.9 $19.6 $78.7 $- $321.2

Entergy Louisiana $276.8 $21.4 $- $- $298.2

Entergy Mississippi $4.8 $0.3 $- $- $5.1

Entergy New Orleans $3.0 $0.2 $- $- $3.2

Entergy Texas $3.3 $0.1 $- $- $3.4

System Energy $396.2 $29.4 ($4.2) $- $421.4

Non-Utility Nuclear $1,228.7 $99.3 $- ($8.5) $1,319.5

Other $1.2 $- $- ($0.1) $1.1

113