Entergy 2009 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

118

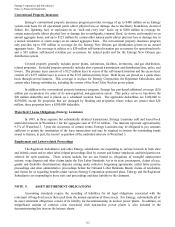

obligation as other comprehensive income. Accounting standards also requires that changes in the funded status be

recorded as other comprehensive income and/or a regulatory asset in the period in which the changes occur.

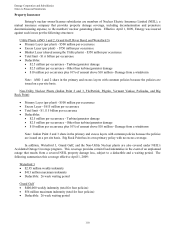

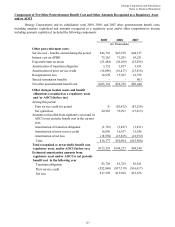

Components of Qualified Net Pension Cost and Other Amounts Recognized as a Regulatory Asset and/or

Accumulated Other Comprehensive Income (AOCI)

Entergy Corporation's and its subsidiaries' total 2009, 2008, and 2007 qualified pension costs and amounts

recognized as a regulatory asset and/or other comprehensive income, including amounts capitalized, included the

following components:

2009 2008 2007

(In Thousands)

Net periodic pension cost:

Service cost - benefits earned during the

period $89,646 $90,392 $96,565

Interest cost on projected benefit obligation 218,172 206,586 185,170

Expected return on assets (249,220) (230,558) (203,521)

Amortization of prior service cost 4,997 5,063 5,531

Recognized net loss 22,401 26,834 45,775

Curtailment loss - - 2,336

Special termination benefit loss - - 4,018

Net periodic pension costs $85,996 $98,317 $135,874

Other changes in plan assets and benefit

obligations recognized as a regulatory

asset and/or AOCI (before tax)

Arising this period:

Prior service cost $- $- $11,339

Net (gain)/loss 76,799 965,069 (68,853)

Amounts reclassified from regulatory asset

and/or AOCI to net periodic pension cost in

the current year:

Amortization of prior service credit (4,997) (5,063) (5,531)

Amortization of net loss (22,401) (26,834) (45,775)

Total 49,401 933,172 (108,820)

Total recognized as net periodic pension

cost, regulatory asset, and/or AOCI

(before tax) $135,397

$1,031,489

$27,054

Estimated amortization amounts from

regulatory asset and/or AOCI to net

periodic cost in the following year

Prior service cost $4,658 $4,997 $5,064

Net loss $65,900 $22,401 $25,641

120